Financials

Canadian Pacific Railway Limited (NYSE:CP) is a company that produces solid earnings growth with more growth expected for 2020. The company operates with high profit margins and strong returns on equity. Over the last decade the company’s profit margins have increased from around 15% up to 27% and its return on equity has increased from around 15% up to 30%.

Canadian Pacific is financially sound with acceptable debt levels. The company’s long-term debt is $8.9 billion (CA dollars), which represents 45% of the value of its assets, and its total liabilities are 75% of its assets value. These levels have being fairly consistent over the last decade.

The company’s working capital is a little light (with a current ratio of 1.06), meaning that the company’s short-term assets (cash and deposits) just cover its short-term obligations (such as bills). However, Canadian Pacific does have a history of successfully operating with low levels of working capital.

In US dollars, Canadian Pacific’s forward PE multiple is 17.2x with a stock price of $219. The company’s trailing PE multiple is 21.6x and its book value multiple is 5.8x. These multiples imply that Canadian Pacific may be a little expensive. Canadian Pacific pays a dividend with a forward yield in US dollars of 0.86% and a trailing yield of 0.83%. The dividend payout ratio is 18%.

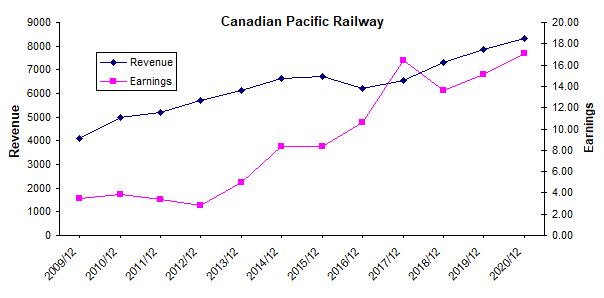

Canadian Pacific has a strong history of growth with its earnings increasing 21% per year over the last decade. The chart below visually shows Canadian Pacific’s revenue and earnings trend in CA dollars over the last decade along with the next two years of consensus forecasts.

Canadian Pacific data from Annual Reports

As the above chart shows, Canadian Pacific’s revenue has increased over the last decade and the forecasts show this trend continuing into 2020. The earnings have broadly trended