Source: Arcosa Investor Presentation

Business overview and the spin off transaction

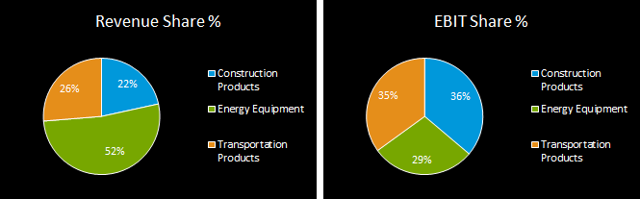

Arcosa (NYSE:ACA), a recent spin off company from Trinity Industries, is a pure infrastructure play. The company operates three main segments - Construction, Energy and Transportation. Although infrastructure spending is highly cyclical, Arcosa is well diversified across its product offering and industries being served.

Source: Arcosa 10-K and 10-Q SEC Filings

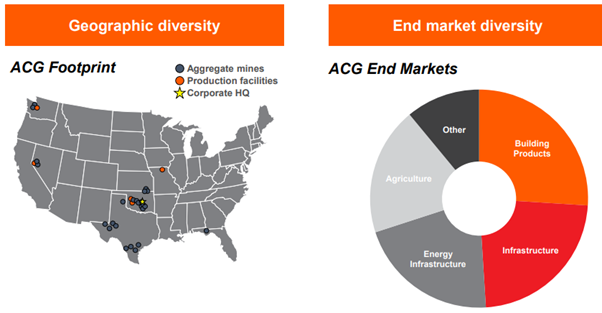

The Construction Products division, produces natural and lightweight aggregates for residential, commercial and industrial construction. As well as materials for bridge and road construction. The specialty materials part of the division has high barriers to entry, selling materials for roads, fracking infrastructure, drilling pads and various agriculture uses. Most of the specialty materials sold were acquired as part of the ACG Materials deal, which increased the business unit revenues by roughly 50%. Finally, the Construction Products division also produces trench shields used for a wide array of underground infrastructure.

Source: Arcosa Investor Presentation

The Energy Equipment division is operates under three sub-segments - wind towers, utility structures (transmission poles) and gas and liquids storage tanks. The wind towers business is heavily dependent on General Electric, which represents 19% of total consolidated revenues as of FY 2018. The business has also been impacted by the planned phase out of the production tax credits and is likely to see further uncertainty over the short-term. Meyer Utility Structures business, acquired in 2014 from ABB, serves municipalities and public and private utilities. The Energy division also serves residential, commercial and industrial markets through the storage tanks segment. Margins are heavily dependent on two factors - steel prices and capacity utilization.

Source: Arcosa Investor Presentation

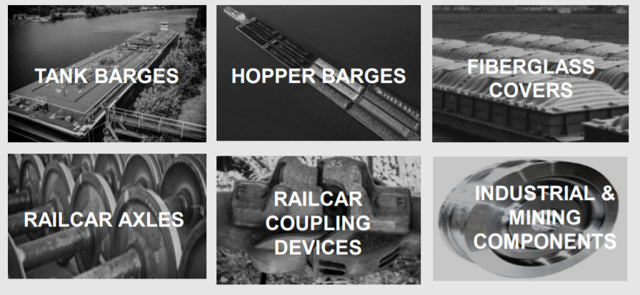

Transportation Products unit is the country largest manufacturer of dry and liquid inland barges servicing energy, chemicals and agriculture markets. Arcosa operates four manufacturing sites, of which three are currently active