Optical communications and commercial laser company Lumentum (NASDAQ:LITE) tumbled over 10% yesterday on news the Trump administration was moving to ban American telecommunications firms from installing foreign-made equipment that could pose a threat to national security. Clearly, the strategic 5G infrastructure build-out was in the cross-hairs. As such, that would effectively bar American technology companies to sell hardware to Huawei - China's leading telecommunications firm.

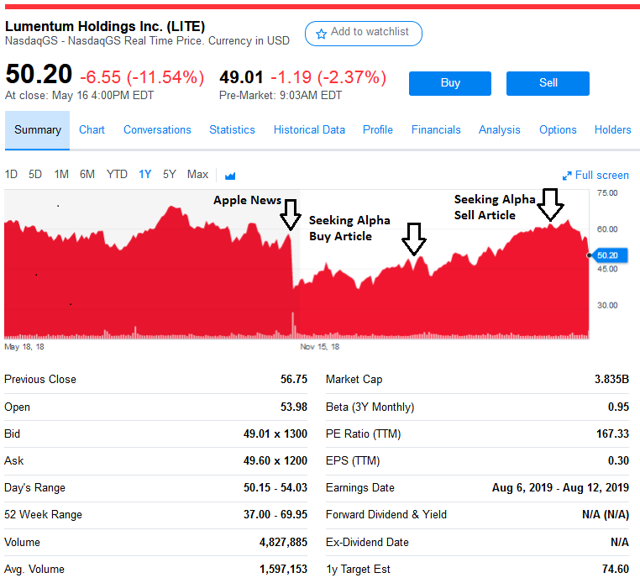

Source: Yahoo Finance

Source: Yahoo Finance

As shown in the graphic above, LITE has been on a roller coaster ride ever since news that Apple (AAPL) was moving away from Lumentum as a supplier of 3D sensing systems for its iPhones. The sell-off was quick and overdone. As a result, I wrote a Seeking Alpha article (Why I Bought Some LITE) suggesting the company's future in 3D sensing products would move to the (bigger..) Android market and that build-out of 5G infrastructure would be LITE's next big growth opportunity.

The stock quickly moved from $44 to $62 (40%) in three months, and I suggested my Seeking Alpha followers take profits (Lumentum: Why I Sold Half). My reasoning was that the stock had simply moved too far too fast. In hindsight, that was a lucky call, considering the big threat was the US/China trade war and the potential for a "ZTE-like" (OTCPK:ZTCOF) ban. The trade war has quickly turned into war over the future of technology and who will control the strategic 5G infrastructure.

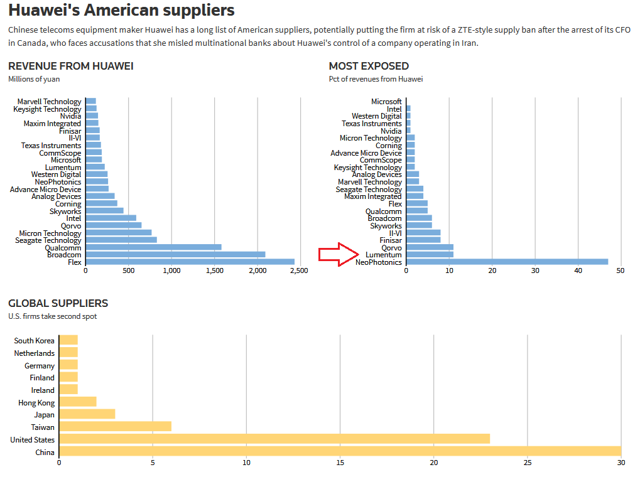

The 11% pullback in the stock yesterday is rational, considering that Huawei is a big Lumentum customer:

Source: Reuters

Source: Reuters

While the graphic above shows an estimated 12% of Lumentum's revenue comes from Huawei, on a JPMorgan Conference Presentation yesterday, management said Huawei's slice of revenue has ranged from 11% to 17% over the past year. Chinese company ZTE was reported to be in the 1% revenue range.