GasLog Ltd. is listed on the New York Stock Exchange under the ticker GLOG and is one of the largest owners and operators of LNG vessels. It has substantially grown its fleet since its listing, primarily recycling its capital through its subsidiary, Gaslog Partners LP (GLOP) which is an MLP vehicle.

The demand for LNG is expected to grow steadily and GLOG is very well positioned to take advantage of this growth. The company enjoys economies of scale from its fleet size, including its ability to recycle capital at attractive terms through Gaslog Partners LP. GLOG is also run by a management team that has a long experience in the shipping sector and the LNG market. These are the reasons for which we believe that the current share price represents a great opportunity to enter the stock at a very opportune timing.

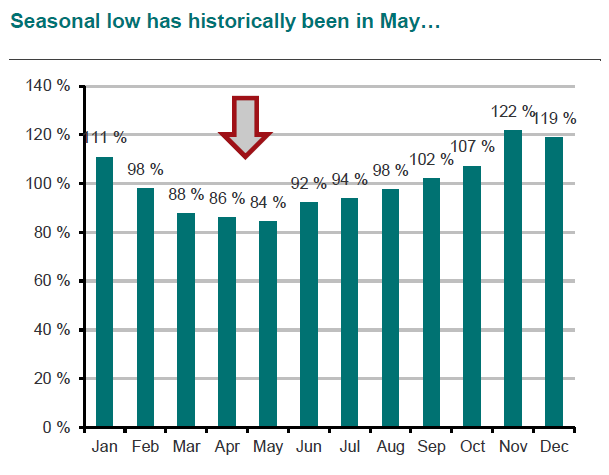

GLOG provides the investors with exposure to the LNG shipping markets that are usually strong around the winter time as per the below graph of DNB Bank ASA with data from Clarksons Research.

Source: DNB Bank ASA, LNG Report dated 9 April 2019

Source: DNB Bank ASA, LNG Report dated 9 April 2019

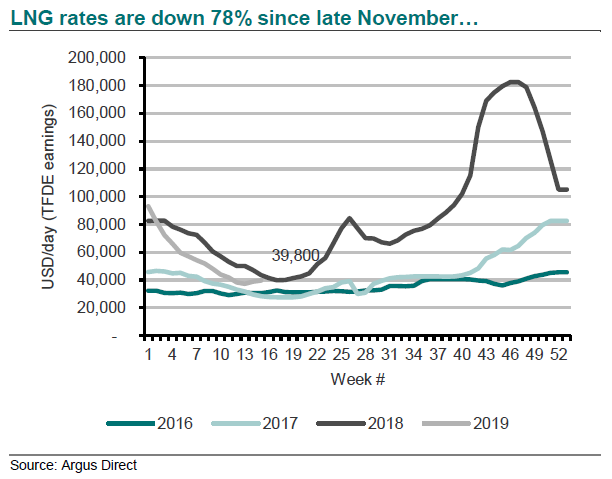

This seasonality relates to the fact that there is increased consumption of LNG in the second part of its year. The past winter 2018-2019 was not an exception to that seasonality pattern and rates have reached about $180k per day for a TFDE vessel in November 2018 followed by a drastic decline in 2019, as per the graph below that also shows the respective increase of the rates towards the end of the year in 2016-2017, as well, albeit at lower absolute levels.

Source: DNB Bank ASA, LNG Report dated 9 April 2019

Source: DNB Bank ASA, LNG Report dated 9 April 2019

The winter in the Asian region was milder than people anticipated and the energy needs were fulfilled by the already high inventory