Note: This article was first published to HFI Research subscriber. This is part of our new Oil Market Fundamental daily report.

Oil prices are pulling back slightly today with Brent underperforming WTI and narrowing the Brent-WTI spread. The move today appears to be speculators dumping long positions going into the OPEC+ JMMC meeting. In the case of surprises, speculators are taking the cautionary stance of being on the sidelines. While, on the macro front, it appears the China/US trade war is heating up leading to lower risk appetite for those betting on oil prices.

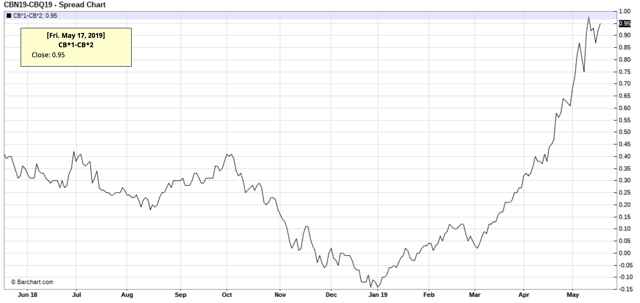

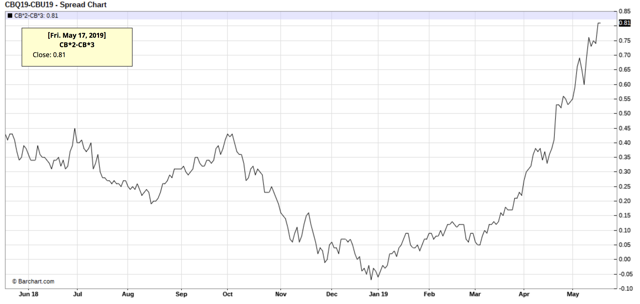

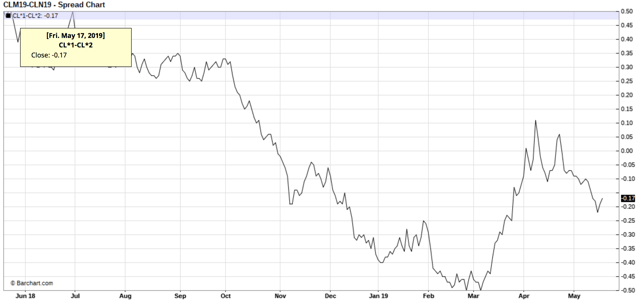

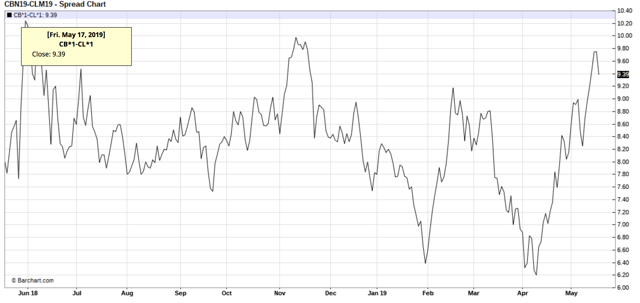

But, on the physical market, the divergence continues with the Brent 1-2 timespread moving up, while Brent 2-3 is flat on the day despite the sell-off. WTI timespreads are also improving, which might indicate that storage draws are coming, although the spreads are still in contango, which is still an illustration that the US crude market remains oversupplied.

Brent 1-2

Brent 2-3

WTI 1-2

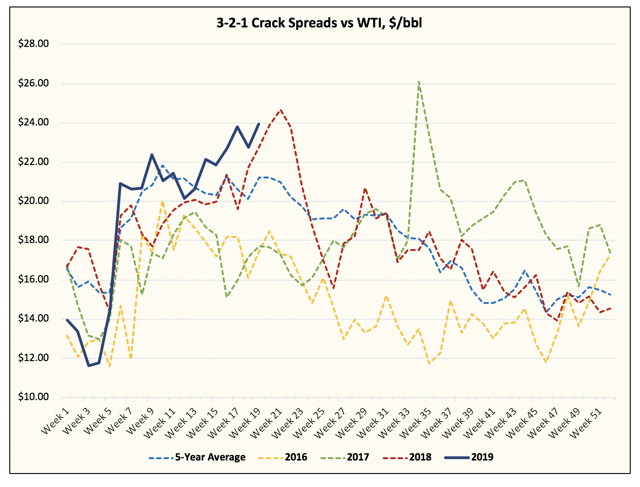

321 Crack Spreads vs WTI

Source: CME, HFI Research

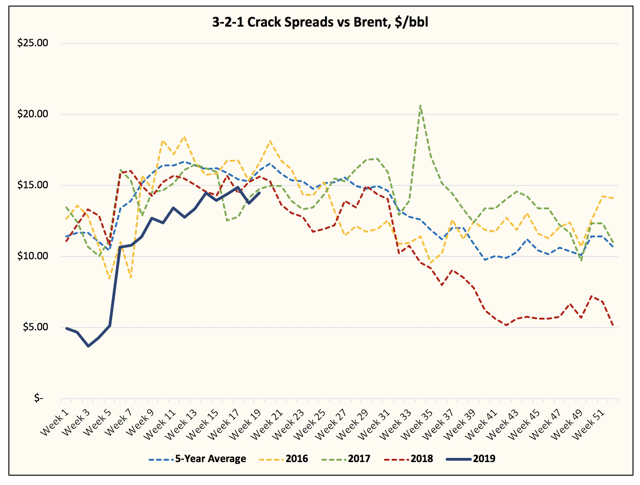

321 Crack Spreads vs Brent

Source: CME, HFI Research

As you can see from the charts above, the physical oil market remains healthy despite headline macro concerns. Whatever financial speculators are doing today, the physical oil traders are completely ignoring. For the US market, we know that unplanned outages continue to dampen US refinery throughput which has led to crude builds over the last month. But this is going to change within the next few weeks as high 321 crack spreads indicate higher refinery runs.

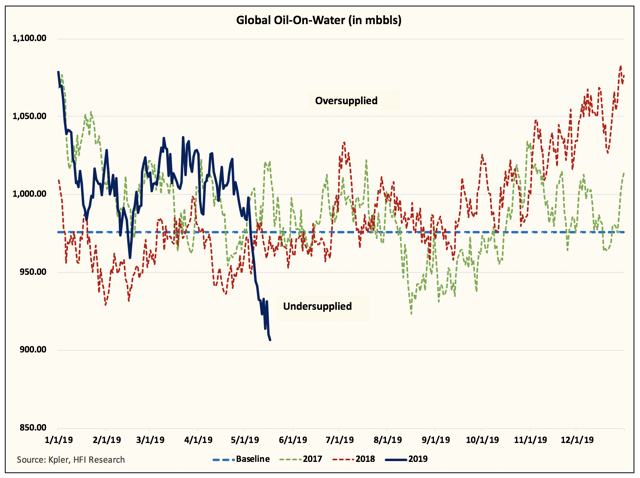

Global oil-on-water

In addition, another metric we track closely is the global oil-on-water, which has reached the lowest level over the last 3 years. The decline since the start of May comes from a steep dropoff in Iranian crude exports which tanker tracking services are pegging at ~500k b/d. Logistical

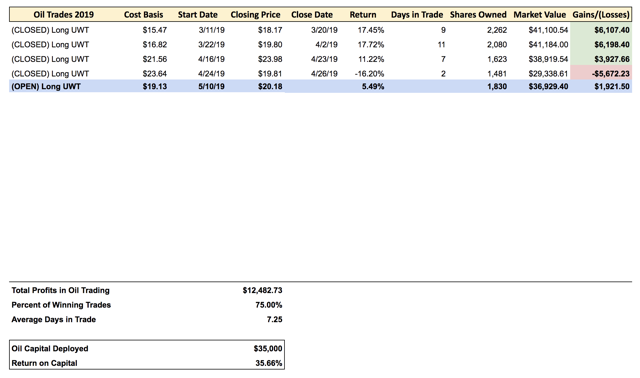

Thank you for reading this article. We recently launched our oil trading portfolio along with the HFI Portfolio. The oil trading portfolio is designed to take advantage of short-term long/short oil trades in the market. For readers interested in our positioning along with real-time trades, we are now offering a 2-week free trial. Here are the results so far: