In my previous article, "J. M. Smucker: Back In A Jif," I went on the record as "very bullish" on J.M Smucker's (NYSE:SJM) shares due to an undervaluation opportunity I saw with regard both to historical premium valuation and to fair value valuation, and recommended a "Buy" on the company stock due to this undervaluation and appealing dividend yield. The 3.3% yield on share price was, simply put, appealing enough to recommend the stock.

Now we're in a different situation, and I've been getting messages (3, in fact) as to whether my thesis and my stance towards the company still holds. I thought this to be an excellent opportunity to update my thesis.

To quickly clarify, my overall bullish stance on the company remains, but my recommendation to buy the stock most definitely does not. Let me show you why.

(Source: Wikipedia)

Thesis update - SJM

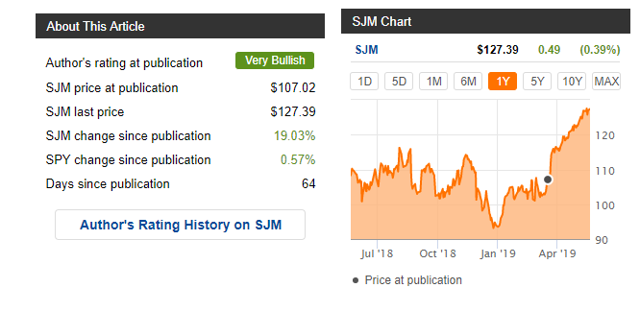

The last article was published about two months back. No quarterly results have been published since, but the stock has done this since that article:

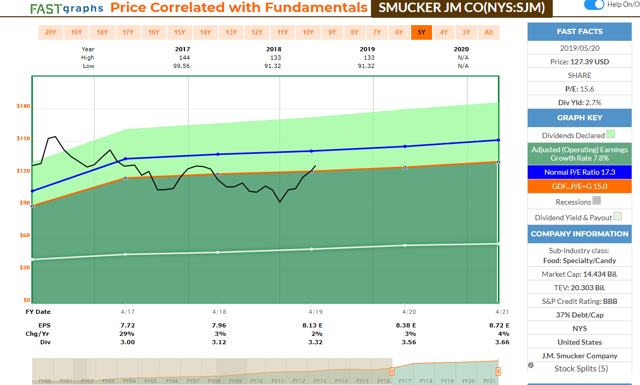

(Source: F.A.S.T. Graphs)

The stock price has appreciated, the yield has dropped, and the share price has breached the line of fair valuation, once more being valued at a blended P/E of ~15. In terms of results after the publication of the article, we're looking at the following development:

(Source: "J. M. Smucker: Back In A Jif," Seeking Alpha, March 18, 2019)

I want to be clear - I'm a long-term DGI investor with a targeted time period of upwards to 25-50 years. Stock price movements such as this generally mean nothing to me, as my target is to sell stocks very, very rarely.

Exceptions must be made, of course, in the cases of gross overvaluation, as it could be considered the height of inefficiency not to sell when a stock is