The only negative aspect in the latest quarterly earnings of Amazon (NASDAQ:AMZN) was the continuing slowdown of top line growth. However, the concerns over a slowdown in revenue growth are exaggerated. The overall revenue growth rate was weighed down by marginal growth in physical stores segment. This segment is unlikely to see big growth unless it is from another acquisition.

Similarly, the online stores segment saw moderate growth of only 12%. This segment has very low profitability which reduces the incentive for the management to improve the growth rates through heavier discounting. The remaining four segments showed a growth rate of 31.5% which is quite good considering the fact that they had a revenue base of over $25 billion in the last quarter. Investors should look at the future revenue share of these profitable segments instead of overall top line growth.

Revenue growth, Much ado about nothing

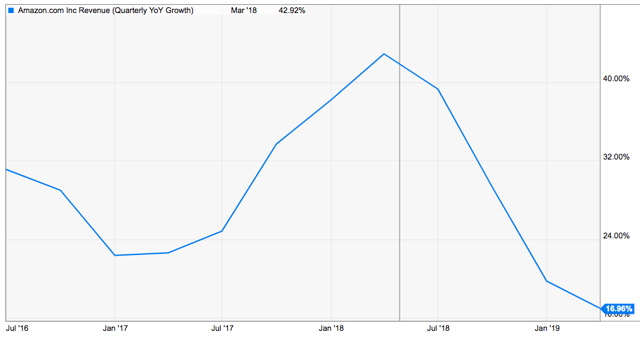

In the year-ago quarter, the revenue growth rate was 42.9% while in the recent quarter it was only 16.9%. On the face of it, this is a big slowdown for Amazon in a short time period. However, we need to examine closely the reasons for this slowdown.

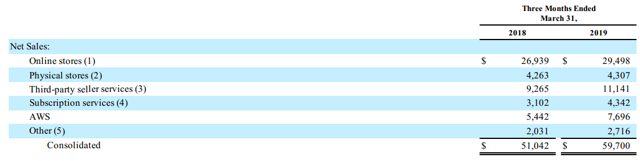

In the year-ago quarter, Amazon received a big boost in revenue due to the acquisition of Whole Foods. The overall revenue was $51 billion out of which $4.3 billion was from this acquisition. If we back out the revenue from the physical stores, the revenue growth in the year-ago quarter comes down to 27.5%.

Source: Amazon Filings

At the same time, these physical stores have seen marginal growth in the last year. Hence, they have brought down the overall revenue growth rate for Amazon in the current quarter. If we remove the physical store sales from this quarter and the year-ago quarter, the revenue growth of the remaining segments comes to