Today, we talk about Adverum Biotechnologies (NASDAQ:ADVM), a stock that has gained 12.79% in the past one week, 38.52% in the past one month, and 191.11% in 2019 YTD. The stock has come 250.00% above its 52-week low of $2.62 and is now just 2.96% lower than its 52-week high of $9.45. Trading at around $9.17, the stock has a market capitalization close to $522.51 million.

I believe that there is significant upside potential still left in this clinical-stage gene therapy stock. In this article, we shall discuss the company’s technology platform, investigational therapies, and their market potential, and implications of recent events on stock price in greater detail.

Company overview

Company overview

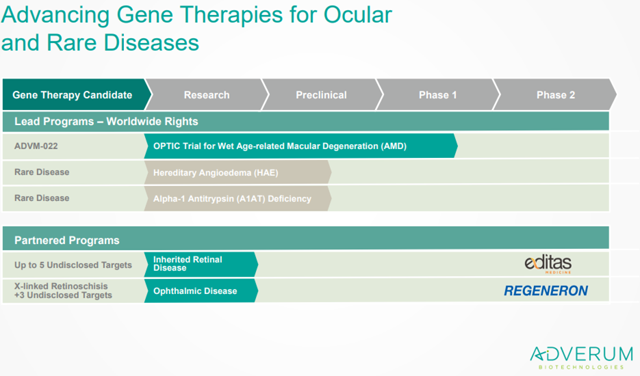

Adverum is a clinical-stage gene therapy targeting ophthalmologic and rare disease conditions. The company is using its next-generation gene delivery vector technology, the directed evolution platform, to develop therapies with improved and durable efficacy. The company uses engineered adeno-associated virus capsids with novel properties such as the improved capability to transduce certain cells or capability to evade certain types of immune responses, to deliver DNA to target cells and induce sustained expression of a therapeutic protein.

Adverum has collaborated with Regeneron (REGN), which is the current leading wet-AMD player with Eylea, for development of up to eight distinct ocular therapeutic targets. The company has also collaborated with Editas (EDIT), to combine its unique gene delivery capabilities with the latter’s CRISPR-based genome editing technology, for effectively targeting upto five inherited retinal diseases.

FDA lifted the clinical hold on OPTIC Phase 1 trial

On May 16, FDA lifted clinical hold for the second cohort of the OPTIC phase 1 trial, thereby allowing for dose escalation of investigational, single-injection gene therapy candidate, ADVM-022, in wet AMD (wet age-related macular degeneration) indication. The company had informed about this clinical hold in