By Eugenio Cerutti, Assistant to the Director at IMF's Research Department, Gita Gopinath, Economic Counsellor and Director of IMF's Research Department, and Adil Mohommad, Economist in IMF's Research Department

US-China trade tensions have negatively affected consumers as well as many producers in both countries. The tariffs have reduced trade between the US and China, but the bilateral trade deficit remains broadly unchanged. While the impact on global growth is relatively modest at this time, the latest escalation could significantly dent business and financial market sentiment, disrupt global supply chains, and jeopardize the projected recovery in global growth in 2019.

Evolution of trade in the US and China

The raising of US tariffs to 25 percent on $200 billion of annual Chinese imports on May 10, together with the announced Chinese retaliation, marks the latest escalation in the US-China trade tensions.

The impact of previously imposed tariffs by the US and subsequent retaliation by China is already evident in trade data. Both the countries directly involved and their trading partners have been affected by rising tariffs.

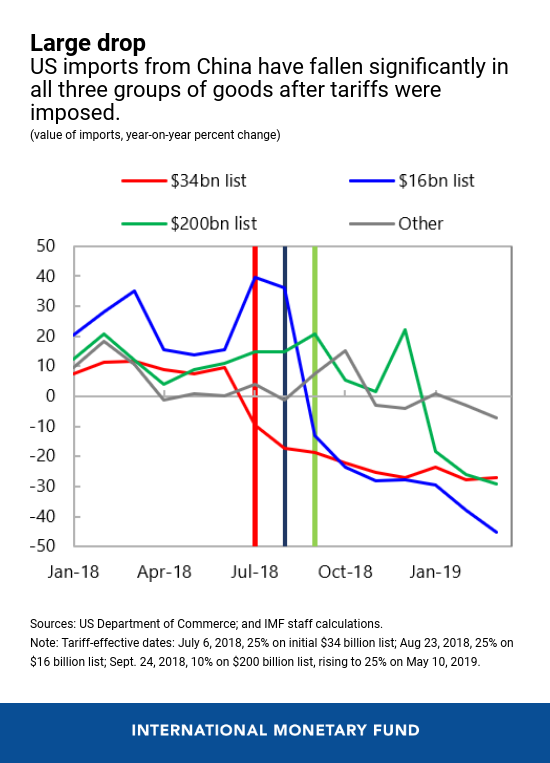

In 2018, the US imposed tariffs sequentially on three "lists" of goods from China, targeting first $34 billion of annual imports, then $16 billion more, and finally an additional $200 billion. As a result, US imports from China have declined quite sharply in all three groups of the goods on which tariffs were imposed.

In cases where there was a delay between announcement and implementation of tariffs, as in the case of the $16 billion and $200 billion lists, or plans to phase in the tariff increase, as in the case of the $200 billion list, we observed an increase in import growth in advance of the effective dates. This suggests that importers stocked up ahead of the tariffs, accounting for the sharper decline in imports thereafter.