Bank of America Corporation (NYSE:BAC) stock price is mostly unchanged from a year ago, but it hasn't been without drama. The good news is that the stock has easily erased most of the losses from December 2018.

The fact that the stock has pulled back in recent weeks isn't necessarily a negative indicator for the company, but rather, indicative of the market backdrop. Although it's important to analyze financial ratios and valuations of companies, the current market is a good reminder of how influential macroeconomic and geopolitical events are for stocks and bonds.

In this article, and the ones to follow, I'll show how the current environment is impacting banks like BofA, but also how the bank is performing fairly well given the backdrop. And I believe the stock will be in a great position to push higher once the current negative catalysts are removed from the market.

Challenging Market and Yield Curve

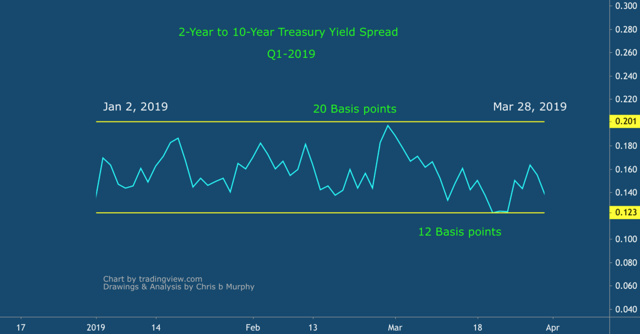

The spread between the 2-year and 10-year Treasuries narrowed and remained tight throughout Q1, as shown below in the chart.

Twenty basis points was the widest spread for the quarter., while it narrowed to as low as 12 basis points near the end of March.

Since banks like Bank of America pay depositors interest based on short-term rates while charging their borrowers based on the 10-year yield, any narrowing of the spreads reduces their net interest income and profits.

The 2-year yield is largely driven by market participants and the Fed's monetary policy. With the Fed on hold, the 2-year yield has been relatively quiet and is unlikely to rise significantly in the short term without any hikes from Jay Powell and company.

The 10-year yield is driven mostly by growth and inflation expectations in the economy. If the market believes economic growth will rise, investors will likely sell