Bellicum Pharmaceuticals (OTCPK:BLCM) just reported interim data for their BPX-601 product candidate in patients with metastatic pancreatic cancer at ASCO. The data confirmed that the company’s “GoCAR-T” technology increases expansion and tenacity of CAR-T cells in the treated patients. Eight of the twelve patients treated with BPX-601 and a single dose of rimiducid experienced stable disease and 3 patients had tumor size reduction of 10-24%. I was encouraged to see BPX-603 continue to report solid marks in the PSMA indications and is shaping up to be one of the first CAR-T products to have a significant impact on solid tumors. I just wish the street would start to recognize BPX-603 and the rest of Bellicum’s developing pipeline of cell therapies. In less than a year, BLCM has traded down from above $10.00 a share to $2.00. Is it finally time for me to press the buy button BLCM?

I intend to review the ASCO BPX-601 data and discuss why these positive results were critical for Bellicum. In addition, I review the charts and share my plan for finally starting a position in BLCM.

BPX-601 ASCO

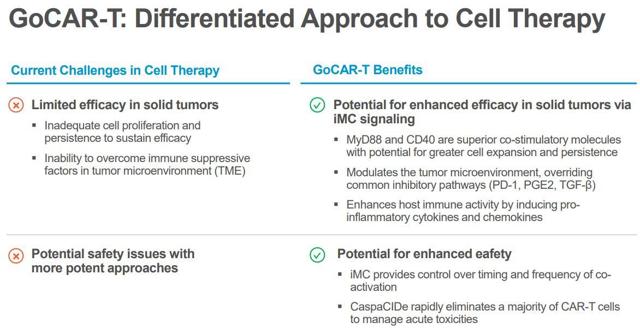

Bellicum’s original GoCAR-T, BPX-601, integrates the company’s “inducible co-activation domain” branded “iMC,” which is intended to deliver a potent enhancement to T-cell proliferation and persistence and permit the CAR-T to control pivotal immune inhibitory mechanisms essential to tumor growth and survival. The BPX-601 program is being assessing GoCAR-T as a therapy for pancreatic, gastric, and prostate cancers that express the prostate stem cell antigen “PSCA”.

Figure 1: GoCAR-T vs Contemporary CAR-T (Source BLCM)

BPX-601’s phase I/II trial registered 18 PSCA-positive pancreatic cancer patients that were treated with BPX-601. The opening 13 patients were administered BPX-601 succeeding Cy lymphodepletion, and 5 patients in the newest cohort had a Flu/Cy lymphodepletion administered