Atomera (NASDAQ:ATOM) is the producer of a coating technology called MST or Mears Silicon Technology. The coating enhances the performance of transistors. From the earnings deck:

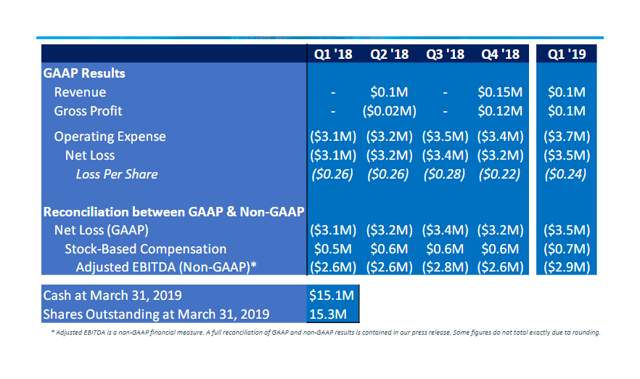

Mears is actually the name of the founder of the company and now its CTO. The company has a couple of hundred patents and pending patents. The license income doesn't amount to a whole lot yet:

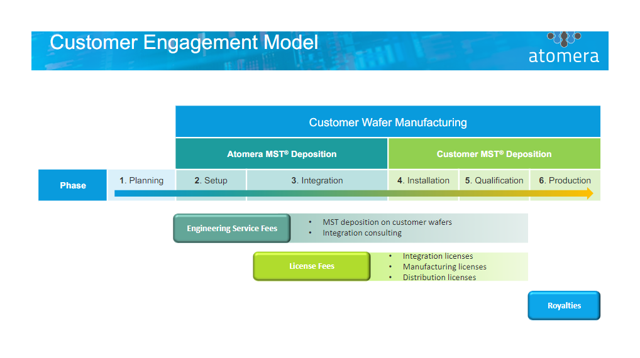

It's a little better than the graph suggests (see below). We're inclined to say that the business model is pretty interesting, with three possible sets of revenue streams:

There are three different types of license grants:

- Integration licenses, which gives the customers the right to integrate MTS on their wafers but this is done by Atomera. At present, AKM and STMicro have integration licenses.

- Manufacturing licenses grant customers the right to deposit MST on their wafers in their own fab, but the customers can only use those wafers for internal testing.

- Distribution licenses allows customers to sell wavers to sell to third parties and Atomera also collects a royalty on these sales.

Apart from these revenue streams there is also engineering services where Atomera provides technical assistance to clients. Here are these revenues:

That's still not much and it's from two customers, integration license revenue from AKM and STMicro. ASC 606 forces the company to recognize revenue only upon delivery of the product back to these clients (after depositing MST on their wavers), so this is a slow grind.

There were also some setbacks as two customers left. One simply used MTS for one segment and they decided to discontinue that segment altogether, but are still in talks with Atomera about MTS use in another segment. The other customer simply didn't have the budget even before any test results became available.

There is however a growing