This research report was produced by The REIT Forum with assistance from Big Dog Investments.

Despite just going ex-dividend, the Annaly Capital (NYSE:NLY) preferred shares are trading at attractive prices. Even though there is only about one penny in dividend accrual, the shares are still attractive.

Some investors may be willing to risk their portfolio on extremely high yields.

Annaly preferred shares come with a risk rating of 1 and yields around 7%.

Today’s preferred shares come from our subscriber article: Preferred Shares Week 154.

Preferred share risks

There are three major risks to a long-term investor going into preferred shares.

- One is that rates move dramatically higher - generally tied to a large increase in inflation. The second is that they buy shares in an mREIT that goes under.

- The second is the scenario that investors should be proactively guarding against. Be wary of taking on preferred positions that might collapse.

- If the investor panics, see early 2016, they might sell their shares at a very low price. Alternatively, if the investor needs capital for a sudden emergency, they might be unable to get a fair price on closing the position. Consequently, even though trading in the preferred shares can be a great way to get paid for knowing how much each share is worth, it should only be done with capital an investor can afford to leave tied up.

Investors should also have an idea of when a preferred share could be called.

The mREITs would likely call the preferred shares:

- If they ceased wanting to use preferred stock in their equity structure (a rare situation)

- If they believed they could issue new shares at a materially lower coupon rate

For instance, if an mREIT had their preferred shares with an 8% coupon, they might look to issue a new series at 7.25%. If they could issue at 7.25%, it would be more likely that they would call.

Most companies only call their preferred shares if the share trades above $25. The share might trade above $25 because investors felt the yield was worth a premium.

Breaking down NLY preferred shares

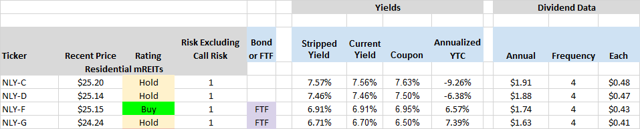

Shares of NLY-C (NLY.PC) and NLY-D (NLY.PD) are both trading with a negative worst-cash-to-call, but the chance of a call in the next few weeks looks low.

Source: The REIT Forum

After the recent call on NLY-H and a decline in both their common and preferred shares, this would be a much more difficult time to refinance NLY-C and NLY-D at a rate that would make calling them worthwhile. Remember, if the mortgage REIT can’t save about 75 basis points, there isn’t much incentive to refinance the preferred share.

NLY-C and NLY-D usually trade with materially higher values for worst-cash-to-call. Negative $.19 for NLY-C and negative $.13 for NLY-D is pretty good. This applies to traders or for buy-and-hold investors.

The buy-and-hold investor going into NLY-D simply needs to think of $.14 from their first dividend as paying back the premium. For NLY-C, it is $.20. In exchange for putting that aside (assuming a call eventually happens), the investor is picking up a yield around 7.5% on a risk rating 1 preferred share.

NLY-F (NLY.PF) is decently into our buy range. A stripped yield of 6.91% isn’t bad and the floating rate is excellent.

NLY-G (NLY.PG) doesn’t get to be in the bargain batch though. At $24.24, shares are only $.91 cheaper than NLY-F at $25.15. The difference in the spread on the floating rate is easily worth more than $.91.

The winter price spread

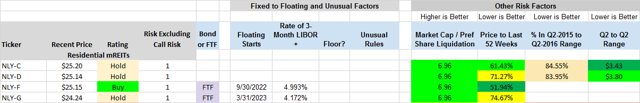

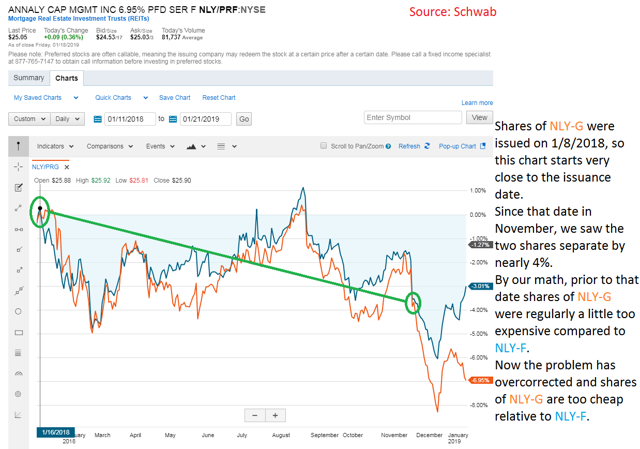

Over the winter we were encouraging investors to take NLY-G when the price spread between NLY-F and NLY-G was at $2.02! That means shares of NLY-G cost $2.02 less than shares of NLY-F. More details were sent to subscribers in Preferred Shares Week 135:

Last week NLY-F dipped back into the strong buy range and was featured here. It rallied $.35 on the week.

Meanwhile, NLY-G dipped $.19 over the last week. The result is a substantial spread between their share prices. At a spread of $2.02, NLY-G looks like a significantly better deal than NLY-F.

Buy-and-hold investors won’t need to ditch their NLY-F in favor of NLY-G. They certainly have that option if they want to reduce their call risk, but it isn’t necessary. NLY-G has a smaller floating rate after call protection ends, so NLY has less incentive to call it. We believe it is quite unlikely that NLY-G will be called. If a call happened, investors with a cost basis of $23.03 would be thrilled with the result.

NLY-G has become much cheaper relative to NLY-F.

So why is NLY-G getting so much cheaper compared to its sister share?

The answer appears to lie in investors (or computer programs) disregarding the call risk and pricing the shares as perpetuities. The difference in the spread over 3-month LIBOR (or whatever index replaces it in the future) is enough to justify a material difference in prices. However, if investors are even a little concerned about call risk, they should favor NLY-G when the prices are spread this far apart.

So far apart should the two shares trade? We’ve tended to figure that it should be around $1.30 to $1.40. A logical case could be made for going up to $1.50 or so. Currently, the spread is $2.02.

If NLY didn’t have the right to call the preferred shares and we assumed that a 7% discount rate was reasonable, then a spread of about $2.54 would make sense. At an 8% discount rate, it drops to a difference of $2.26. and at 9% it would be $2.04. If investors feel a 9% discount rate is absurdly high (given current stripped yields around 7%), we agree.

However, preferred shares often encounter more resistance to moving more than a few cents over $25.00 because many investors refuse to pay a premium to call value. Consequently, it is far more likely that NLY-G would catch a bid (rise in price) than it is that NLY-F would catch a larger bid.

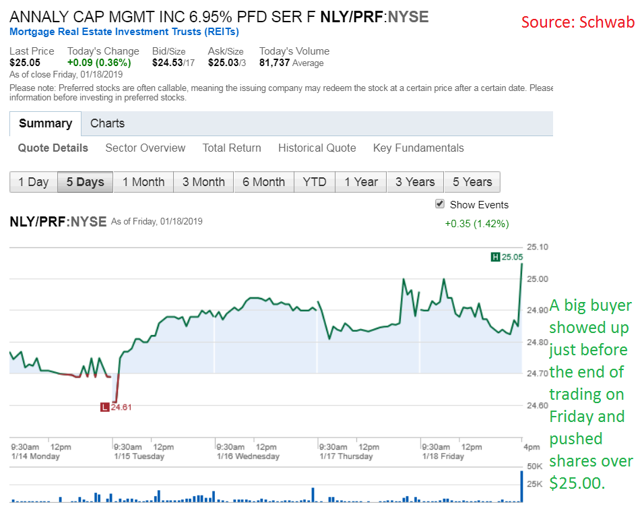

We like the valuation on NLY-G better here since it gives us more potential for price gains and materially less call risk. On Friday, just before the close, we traded our large position in NLY-F for a large position in NLY-G. (Selling NLY-F to fund a purchase of NLY-G)

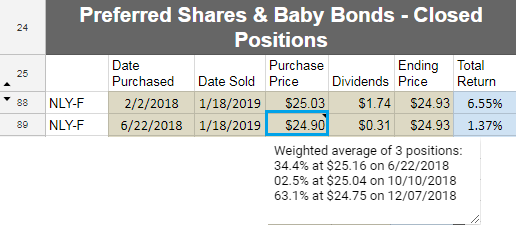

We had built the position in NLY-F in two batches, one was purchased nearly a year and the rest were purchased from summer 2018 through winter 2018:

At that point, we swapped from NLY-F into NLY-G. Today, NLY-F is much more attractive again.

Importance of diversification

While most of our coverage is on REITs with far less than average risk, The REIT Forum still recommends diversifying. We invest the substantial majority of our portfolio in REITs and preferred shares. We suggest that investors choose a maximum allocation using our risk ratings combined with their risk tolerance. Each of our risk ratings connects with a suggested maximum allocation. The maximum allocations generally range from 1% for higher risk options to 6% for our lowest risk choices. By diversifying among these choices investors can build a portfolio with a less volatile value and more consistent dividend growth.

Final thoughts

For investors looking to get into Annaly preferred shares, NLY-F is at a great bargain price. NLY-C and NLY-D are options for investors who are looking for a higher yield and willing to take on a bit of call risk. In the current market environment, we believe investors should primarily invest their portfolios in risk 1 and risk 2 investments. Safer investments with a better balance sheet are better equipped to weather a significant market downturn.

NLY preferred shares are some of the safest securities in the sector.

We will have a new article on Annaly's common shares soon. Please make sure to follow us so you get an alert when it comes out.

The REIT Forum is the #1 rated service on Seeking Alpha.

Bought VNQ (REIT index ETF)? Your returns track the red line. Bought PFF (preferred share index ETF)? Your returns track the yellow line. Why index? By carefully picking individual shares, we've been able to dramatically outperform the indexes for our sectors.

Try a Free 2-week trial today. You can use your Seeking Alpha account.