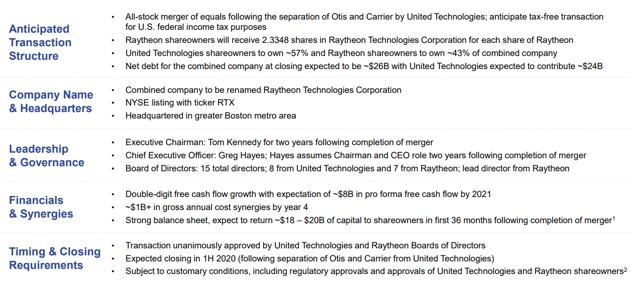

United Technologies Corporation (NYSE: UTX) is a more than $110 billion conglomerate, while Raytheon Company (NYSE: RTN) is a more than $50 billion U.S. defense contractor. The companies just announced that they were merging in a merger of equals, with Raytheon shareholders getting 43% of the company and United Technologies Corporation getting 57% of the company. The new company will be called Raytheon Technologies. The purpose of this article is to discuss this merger in detail and why it is a strong investment opportunity.

Transaction Overview

Let’s start with the meat of the deal, or the transaction and the details around it.

(Transaction Overview - Combined Company Investor Presentation)

United Technologies as a company has three main operating groups. This is the core company, which contains the Pratt & Whitney division and the Collins Aerospace divisions. The other is the Otis division, which manufactures elevators, escalators, and so on. This is the largest such company in the world with more than 2 million such devices on service contracts, and many others being built.

The last division is the Carrier division. This division is a global provider of HVAC, refrigeration, building automation, fire safety, and so on. As part of the deal, United Technologies will continue its previously announced plan to separate Otis and Carrier into two separate companies. Going forward, the new company, “Raytheon Technologies Corporation,” will be made of the leftover parts of United Technologies.

Another financial aspect for the deal is the net debt of the company will be $26 billion. Out of this, $24 billion will be contributed by United Technologies. Still the combined company will be much stronger financially given its enormous size.

Going forward, the company expects $6 billion in combined cash flow for the year, which it expects to grow to $8 billion by

Invest Better - Free Trial!

Regardless of your general investing goals, The Energy Forum can help you build and generate strong income from a portfolio of quality energy companies. Worldwide demand for energy is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Deep-dive research reports about quality investment opportunities.

- A managed model portfolio that generates a yield of >10%.

- Macroeconomic overviews of the oil market as a whole.

- Technical Buy & Sell Alerts to open up positions at opportunistic prices.