Micron (NASDAQ:MU) is a fascinating stock. It is a purely cyclical and momentum-driven stock and as such experiences huge swings in both directions. Euphoria and fear, as distinct as they are, are as omnipresent as ever in the daily, weekly and monthly price movements in Micron's stock.

Source: thestreet.com

The stock is trading at a mid single-digit P/E ratio despite the company still posting profits and owning a cash-rich balance sheet. Micron has been pouring a lot of money into stock buybacks but despite a positive impact on EPS there is no visible and sustainable impact on Micron's stock price.

A dividend would send a strong signal about management's confidence in long-term profitability and could also attract a new breed of investors that may push the P/E ratio towards normal levels.

What's going on at Micron?

Micron's latest earnings surprised investors with a double-beat but downside guidance for Q3 punished the stock and has sent it back into the low $30 price range. Revenue is expected to be at least $200M shy of initial expectations with margins compressed into the high 30% area. Capex has been cut by at least $500M as a reaction to oversupply in the DRAM/NAND markets and an effort to help boost FCF for share repurchases.

Inventory levels are high and the escalating trade war between the U.S. and China is detrimental to Micron's business. With Huawei blacklisted this will adversely impact memory demand and investors should see the effects of that in Micron's upcoming earnings release.

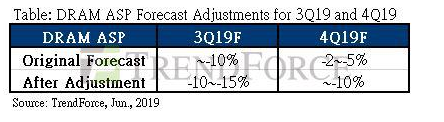

DRAMeXchange has just released its projections for the market and is expecting a whopping 15% decline in the third quarter contrary to the recovery Micron's management has been guiding for the third quarter.

While that's good for customers it is bad for Micron and depending on how they balance