Our long-held contention is that when you buy shares in Melco Resorts & Entertainment Limited (NASDAQ:MLCO) you are fundamentally placing a bet on its CEO and principal shareholder, Lawrence Ho, scion of the legendary Asian gaming family. This is one smart gaming guy who knows how to balance the size of his stomach to the wideness of his eyes.

Despite a so-so 1Q19 result, there is much to like about MLCO stock in general, and in particular, Ho’s vision. You want to be partners with a guy like this - but not perhaps yet. The stock needs time as the US/China tariff war must go through its long period of marination of threats, counter threats, and make nice promises kept or broken.

The long-festering dispute is cited by most observers of the Asian casino business as the principal headwind among several others, suppressing the sector. Yet a longer term look at MLCO is highly encouraging.

In brief, MLCO’s 1Q19 produced $407m in property EBITDA, up 1% y/y. Luck adjusted property EBITDA was down 10%, y/y to $362m. Favorable VIP hold affected City of Dreams Macau, Altira, and City of Dreams Manila. (Favorable VIP hold contributed to performance at City of Dreams Macau, Altira and City of Dreams Manila). Yet MLCO’s VIP segment contributed only 10% to its total GGR for the quarter, indicating its swerve to strong premium mass and mass in the coming quarters will positively impact its cost profile and provision for bad debts.

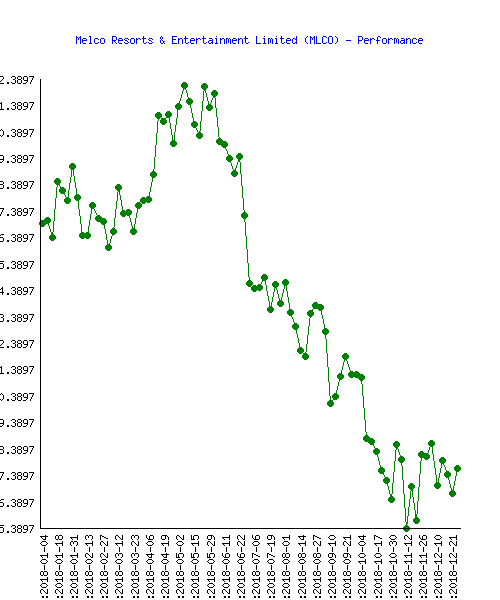

Melco has taken a beating with the sector, but long term looks like a big winner given its strategy: Source: Google finance

Melco has taken a beating with the sector, but long term looks like a big winner given its strategy: Source: Google finance

The company’s bad debt provision for the quarter rose to $11 million, up substantially y/y from $4m which negatively affected EBITDA by $14m. In their earnings release, MLCO executives pointed out that a range of $8 to $12m in bad

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.