Introduction

In recent quarters, Hasbro had to contend with two particular problems. After the sudden collapse of Hasbro Toys 'R' Us, Hasbro had to find new avenues to sell its products.

Furthermore, Hasbro faces changing consumer shopping trends:

- Bricks and mortar retail is struggling.

- E-commerce is on fire and there is no end in sight to Amazon's almost exponential growth. Millennials are less likely to drive to a store than their Boomer parents and grandparents.

Given that, the Hasbro shares have been trading in a downward trend since the beginning of 2017. In recent weeks, however, the share price has significantly exceeded this trading range:

(Source: Hasbro's trading range since 2017)

This is a clear buy signal and could be a good buying opportunity. However, in the following I would like to analyze whether the company is also a buy from a fundamental point of view or not.

Fundamentals

Cash return to shareholders

Hasbro has returned a lot of capital to its shareholders with dividends and share buybacks.

Hasbro offers attractive dividends to shareholders. These are the highlights:

- payout ratio: 63.31%

- actual yield: 2.53%

- five year growth rate: 15.44%

- dividend growth: 16 Years

- next ex-dividend date: 07/31/2019

The dividend yield is within the range of the last 10 years. This initially indicates a fair valuation.

(Source: Macrotrends)

The dividend is also more than twice as high as the Disney (DIS) dividend. Nevertheless, with 26% Disney has the lower payout ratio. Disney also has slightly higher dividend growth.

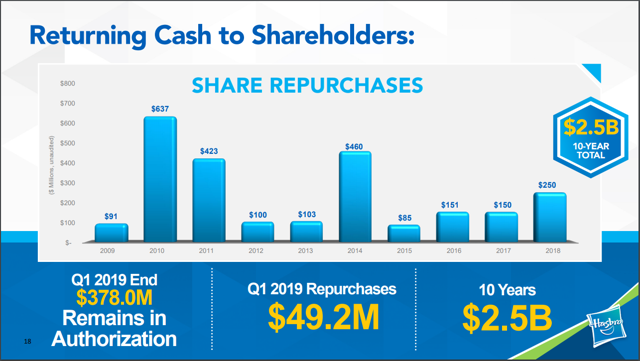

In addition to dividends, the Hasbro returns capital to its shareholders through share buybacks. In the past 10 years, Hasbro bought USD 2.5 billion of its shares.

(Source: Share repurchases)

P/E ratio

The actual P/E ratio is 38.26. This is far above the average for the last 10 years and signals a