The biopharma sector has turned into some of the deepest value stocks in the market. The Allergan (AGN) acquisition by AbbVie (ABBV) is a prime example of a deal where the involved stocks trade at insanely cheap valuations causing the merger synergies to provide a big boost to the EPS estimates despite a large cash portion of the deal. For these reasons, Allergan shareholders should hold the stock through the merger process.

Source: AbbVie/Allergan merger presentation

Merger Details

The AbbVie acquisition of Allergan is a merger that has been in works for weeks according to CNBC, but a merger that is based on an extended period of weakness for the stocks involved. Even after the merger surge, Allergan is still down 50% from the highs above $330 and still down 27% over a 3-year period.

For this reason, AbbVie was able to offer $188.24 per share to acquire Allergan that had dipped to $115. The deal includes $120.30 in cash and 0.8660 per share in AbbVie stock.

The deal value of about 64% in cash helps cushion the weakness in AbbVie, but the nearly 15% weakness in AbbVie initially strips about $10 in deal value. With AbbVie at $67, the deal still offers a value of $178 for Allergan shareholders.

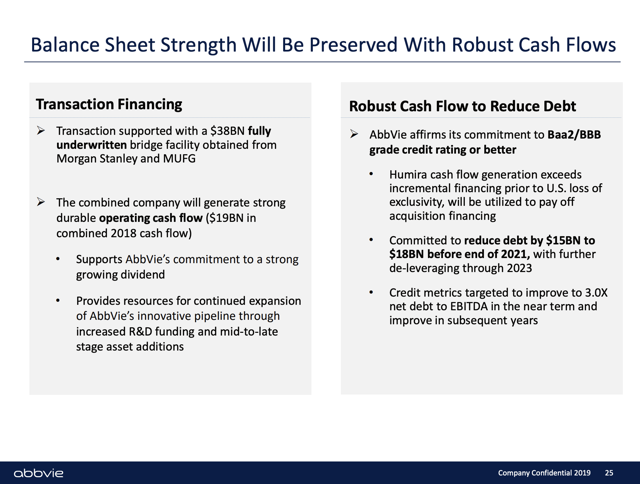

AbbVie will have to pay about $40 billion in cash to close the deal. The company forecasts operating cash flows hit ~$19 billion last year and the goal is repay up to $18 billion in debt by the end of 2021.

Source: AbbVie/Allergan merger presentation

Allergan ended Q1 with a massive debt load of $21.7 billion so the deal doesn't come without some massive debt concerns. Despite AbbVie having a solid balance sheet, the combined balance sheets had net debt of ~$18.5 billion with another $40 billion added to close the deal.