Investment thesis

Whereas fundamentals keep steadily improving, shares of Booking Holdings (NASDAQ:BKNG) have not moved significantly over the last two years. With valuation at historically low multiples, I believe the company’s shares are up for a next leg up in a not too distant future.

Corporate profile

Corporate profile

Booking Holdings is a provider of travel and restaurant online reservation and related services, operating six brands under its wings. Formerly known as Priceline.com, Booking Holdings today manages a portfolio consisting of five other brands – KAYAK, Booking.com, Agoda, Rentalcars.com and OpenTable. Most of the company’s revenues are derived from commissions earned from facilitating reservations of accommodations, rental and other travel services, provision of advertisement spaces and ancillary services such as insurance mediation.

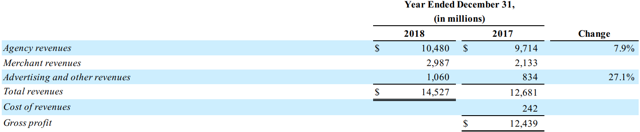

Source: Booking Holdings' 2018 10-K filing

Source: Booking Holdings' 2018 10-K filing

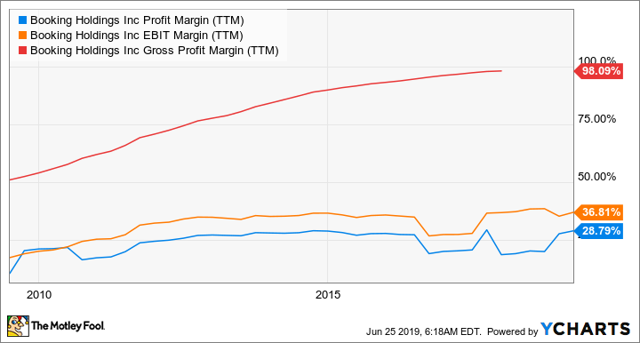

High-margin industry

Having a closer look at what is stands behind Booking Holdings’ success, robust and sophisticated technology platforms coupled with expanding e-commerce industry cannot go unnoticed. These highly liquid factors are apparent also on the company’s profitability measures which belong to the highest within leisure & recreation industry.

DCF model valuation

DCF model valuation

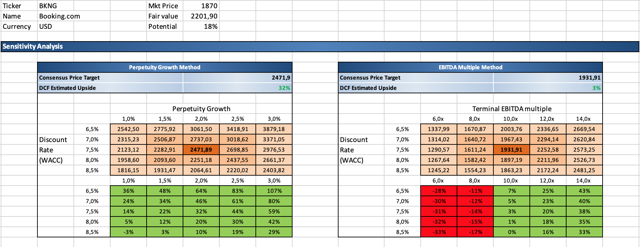

Plugging-in Booking.com's financial statements' figures into my DCF template, the company’s shares show to be undervalued. Under perpetuity growth method with a terminal growth rate of 2 percent, 16 percent annual revenue growth rate assumption (decreasing by 1 percent each year over the next five years) and 35 percent EBIT margin (decreasing by 1 percent each year over the next five years), fair value of the stock comes at 2471 USD. Under the EBITDA multiple approach of a discounted cash flow model, the intrinsic value per share value of the company stands roughly at 1932 USD if we assume that the appropriate exit EV/EBITDA multiple in five years' time is around 10x.

Source: Author's own Excel model

Source: Author's own Excel model

A decreasing number

Global Wealth Ideation, A new marketplace service focused on discovering ideas with wealth building potential

Want to find out more? If you like to get access to in-depth articles that include discounted cash flow analysis, insights from equity analysis tools and prospectively much more, consider joining Global Wealth Ideation!

Join us today and get instant access to all articles and community of engaged investors aiming to benefit from growth opportunities all around the world.