As I depicted in yesterday's article for Seeking Alpha readers, there is an anomalous trade in small-cap stocks each July. On average, S&P Small Cap 600 Index (IJR) regularly outperforms the more widely referenced Russell 2000 Index (IWM). The July monthly excess return (+60bp on average for the past 25 years) is large and statistically significant, especially for two indices that purport to capture the same market cohort.

The reason for the regular outperformance is unlikely to be arbitraged away by savvy market participants. In fact, arbitrageurs drive the performance differential. One of the reasons that the S&P 600 Small Cap Index has outperformed the more popular Russell 2000 is a simple matter of index construction.

Why does this phenomenon exist? Firms that are expected to be added to the mechanical Russell indices gain in June as investors seek to front-run index reconstitution and the forced buying by the funds that replicate the indices. These firms then lose in July and August as the added firms return to levels more reflective of their fundamentals. This drives the outperformance of the S&P 600 relative to the Russell 2000 in July and, to a lesser extent, August.

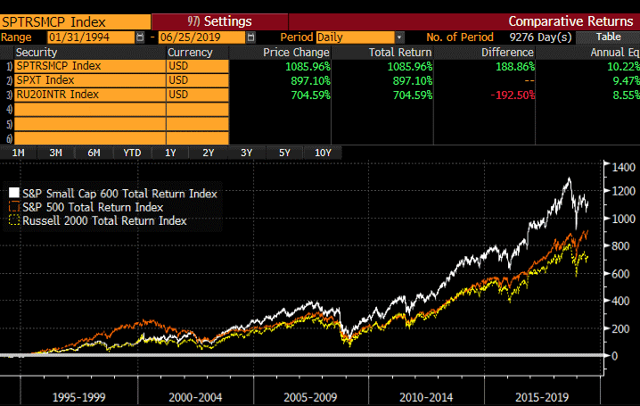

The calendar effect drives meaningful difference between the two indices, but it does not account for all of the differential. In my dataset from 1994 to now, the S&P 600 Small Cap has outperformed the Russell 2000 by 167bp per year. The 60bp average outperformance in July and 19bp outperformance in August explain nearly half the differential, but there must be something else at work.

Source: Bloomberg

The S&P SmallCap 600 requirement that constituents be profitable for four trailing quarters before inclusion produces the second-largest source of differentiation between the two indices. In Standard & Poor's March 2015 small-cap research piece, "A Tale of