By Philip Lawlor, managing director, head of global markets research

Risk appetite has been swinging from concern about slowing global growth and profits to optimism that aggressive Fed easing was just around the corner. Optimism appears to have won the day, at least for now. Hints last week of the Fed's readiness to cut rates sparked a global equity rally, with US stocks notching new highs.

The Fed's latest dovish nod joined similar remarks from European Central Bank and the Bank of England, reinforcing the prevailing assumption that central banks will always be there when markets need them. But such confidence can also breed complacency.

In this environment, bad news is being viewed as good news as it is seen to be forcing the Fed's hand. That makes it particularly important, in our view, to take a clear-eyed assessment of the potential risks that could catch equity markets off guard. Our latest review of global equity conditions highlighted several of them.

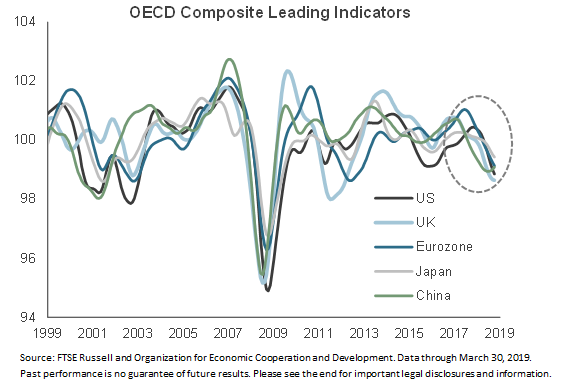

Risk #1: deteriorating growth

Evidence that the global economy is slowing continues to mount. As the chart below shows, leading indicators from the Organization for Economic Cooperation and Development (OECD) are now at or near levels last seen at the height of the European debt crisis in 2012. A protracted trade war, a hard Brexit, an Italian debt crisis, and/or a resumption of the US dollar rally top the list of additional threats to global growth.

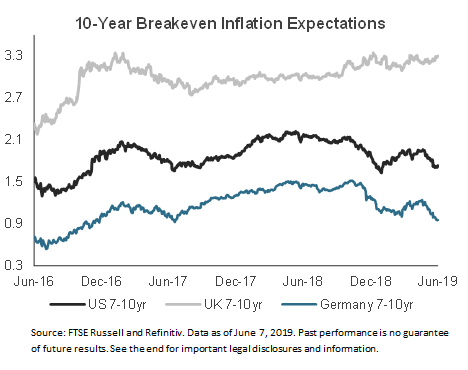

Market inflation expectations have declined significantly since April (see chart below) and dropped even more following the Fed's June meeting, further confirming a more downbeat global growth outlook.

Risk #2: dwindling earnings support

Falling economic growth and inflation expectations raise the risks to revenue and corporate earnings prospects. Indeed, as the chart below shows, earnings momentum has deteriorated in most markets since late 2018, with the uptrend