AbbVie (NYSE: NYSE:ABBV) recently announced a plan to acquire Allergan (NYSE: AGN) for more than $60 billion. That's a sharp drawdown from Pfizer's (NYSE: PFE) offer to buy the company for $160 billion in 2015, a deal that ultimately didn't work out after tax law changes ended one of the major benefits of the deal, which was to allow Pfizer to lower its taxes by $1 billion annually.

Still, AbbVie's acquisition offer was 45% above Allergan's closing stock price before the deal, although that's more like 35% after AbbVie's stock price drop. That stock price drop has also pushed up AbbVie's dividend yield to more than 6%, making it one of the highest yielding dividend aristocrats. I see this as short-term pain that'll soon be reserved.

As we'll see throughout this article, the combined company's R&D business, along with its cash flow abilities make it a top-tier investment opportunity.

Transaction Overview

The basis of any transaction is the price that's paid, and more importantly, how that price is paid. An all cash deal has significantly different implications from an all stock deal. I will come out into the open here by stating that I am rarely a fan of heavily stock based transactions. I believe if a transaction is accretive, with long-term benefits, then it should be paid for in cash.

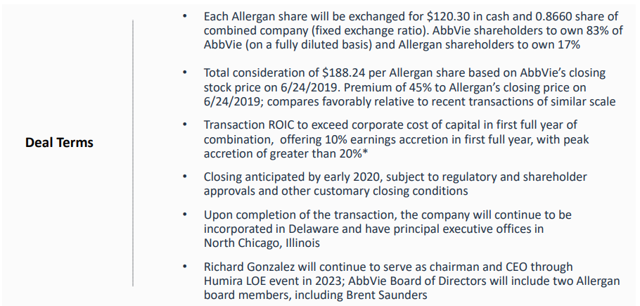

Deal Terms - Merger Investor Presentation

The deal terms involve each Allergan share being exchanged for $120.30 in cash + 0.8660 shares of the combined company. Based on current share prices, which makes the share component of the deal equivalent to $58.89 / share. This makes the total share price equivalent to $179.19 / share for Allergan. For reference that is more than 9% above the company's current share price.

That means that there is

Invest Better - Free Trial!

Regardless of your general investing goals, The Energy Forum can help you build and generate strong income from a portfolio of quality energy companies. Worldwide demand for energy is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Deep-dive research reports about quality investment opportunities.

- A managed model portfolio that generates a yield of >10%.

- Macroeconomic overviews of the oil market as a whole.

- Technical Buy & Sell Alerts to open up positions at opportunistic prices.

If you're interested in learning more, click here. If you have any questions, send me a PM.