Charles Schwab (NYSE:SCHW), the powerhouse asset gatherer that used to be known as a discount broker, reports their 2nd quarter 2019 financial results on July 16, 2019 (still unconfirmed by Briefing.com) before the opening bell.

Analyst consensus is expecting $0.66 in earnings per share on $2.688 billion in revenue for expected year-over-year growth for Q2 '19 of 10% and 8% respectively.

The stock is facing a number of headwinds since May '18:

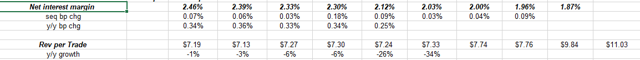

1.) No question the flatter yield curve seems to have had a deleterious effect on Financials and the stock prices the last 18 months, although Schwab's net interest margin is still healthy. (Note the y/y growth of the "NIM" (net interest margin) despite the fact the Fed/FOMC started hiking rates in December '15.)

Source: Internal financial modeling and valuation spreadsheet

2.) The 2nd headwind is also found on the above spreadsheet as it shows the net revenue per trade gradually shrinking as Schwab, Fidelity and TD Ameritrade engage in a price war of slashed commissions and lower mutual fund and ETF fees. In some cases, ETF trades are free depending on what is being traded.

That will be a headwind that could last a while for Chuck and one reason I think commissions could eventually go to zero for the industry, as management fees and longer-term relationships like the advisory business become even more important to the revenue and fee stream than they are already.

Revenue and EPS estimate revisions:

Let's go to the numbers:

| Q2 '19 (estimate) | Q1 '19 | Q4 '18 | Q3 '18 | |

| 2021 EPS est | $2.89 | $3.14 | $3.25 | $3.55 |

| 2020 EPS est | $2.79 | $3.01 | $3.11 | $3.20 |

| 2019 EPS est | $2.70 | $2.78 | $2.85 | $2.89 |

| 2021 est EPS gro rt | 4% | 4% | 5% | 11% |

| 2020 est EPS gro rt | 3% | 8% | 9% | 11% |