Research performed by Zhicheng (Jason) Zhang at DX2 Capital.

Introduction

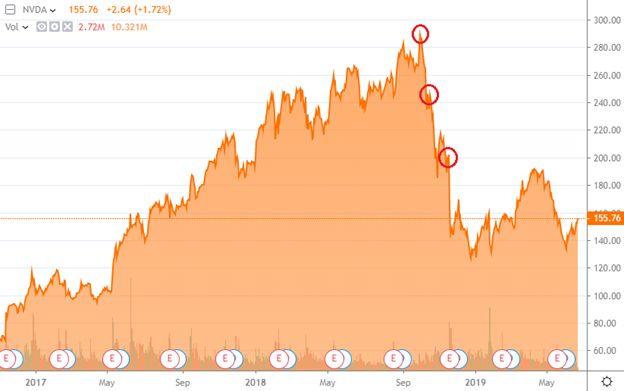

Nvidia (NASDAQ:NVDA) needs no further introduction. The GPU giant was a Wall Street darling for a stretch of almost 4 years, from 2015 until late 2018. During that period, Nvidia’s stock price soared by more than 1,300%, from $20 (01/2015) to $280 (10/2018). The stock was unstoppable, and every quarterly earnings seemed to be a beat and raise. Its business was taking off, fueled by strong demand and the growth in gaming, AI computing, self-driving, and cryptocurrency.

Numbers then started to cool off in November 2018, when Nvidia reported a Q3 revenue miss and Q4 guide down (expected revenue $3.3B down to $2.7B), followed by another guide down in January (from $2.7B to $2.2B). The stock then plummeted to a low of around $130 in January 2019 when the crypto bubble busted.

Since then, Nvidia has reported two uninspiring but tolerable quarterly results. Investor sentiment has been cautious as the full-year outlook is unclear, and the ongoing US/China trade war obviously does no good to the stock price. A combination of negative sentiment, cautious outlook, and low expectation has taken Nvidia’s price near a 2-year low. Given the strong fundamentals of Nvidia’s business, we believe the longer-term prospect is solid, and the stock is worth investigating at the current price level.

Investment Thesis

We see four driving engines for Nvidia’s future recovery and growth:

1. As the dominant provider of GPU hardware, Nvidia will be able to ride the wave of artificial intelligence and enjoy growth in the next several years.

Artificial Intelligence and Machine Learning have played an important role in how business and society operate. According to a survey conducted by Cisco Systems in 2018, more and more companies have expressed that they are reliant on AI and ML.