Discovery Communications Has a True Value Which Is Much Higher Than Today's Stock Price

With the company's very strong Q1 2019 performance, the Discovery Communications Class A stock (DISCA) true value target price is $48.62 per share or over 53% above today's price. DISCA will continue to grow its free cash flow this year. Free cash flow was $492 million in Q1 2019, through cost and merger synergies with its Scripps Network Interactive which it has now owned for a year. A significant catalyst is the company's newly declared $1 billion share buyback program, which was announced in the company's Q1 2019 earnings results. This should push the stock to its true value. This article describes the calculation of our valuation target price.

Valuation

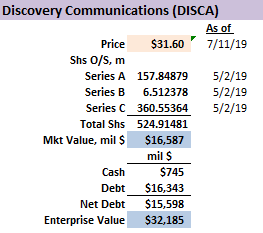

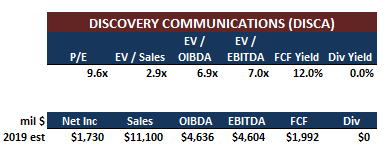

Based on the company's recent financial results, I have estimated the stock's valuation metrics on a pro forma basis for 2019:

Source: Hake estimates

Source: Hake estimate

DISCA sells for less than 10x estimated 2019 net income and 7x EV/EBITDA. More importantly for comparison purposes, its free cash flow (FCF) yield is very high at 12%. In fact, FCF yield could end up being even higher than this. For example, as of Q1 2019, management reported that the past 12 months FCF was $2.8 billion, including $300 million of cash severance and restructuring costs paid on a one-time basis. I decided to use a more conservative estimate of $2 billion, or 4x the FCF numbers achieved by DISCA during Q1 2019. As a percent of sales, the FCF margin is very high at 17.9%. As seen below, both the FCF yield and FCF margin are much higher than DISCA's peers.

Comps And True Value Calculation

The true value is calculated by comparing the value metrics with a number of peers. The average of these calculations is then