VICI Properties (NYSE:VICI) is positioned to exploit what I believe is mispricing between real estate asset classes. Casinos and other gaming assets trade at a 200-400 basis point premium to similarly located real estate of more traditional asset classes like apartments, office, industrial, and retail. I do not believe this pricing difference is justified by either the risk or growth profiles of gaming assets relative to other RE. VICI is trading at an opportunistic valuation of 13.5x 2020 estimated FFO (Capital IQ consensus) and has a highly accretive acquisition pipeline. We see a fair value of $24.80 which represents about 10% upside from today's price.

Mispricing of gaming assets

Most real estate assets trade on a spread above treasuries such that their cap rates move roughly in parallel with the ten-year treasury rate. With interest rates remaining low as long as they have, the cap rate on most REIT caliber real estate assets is also quite low. For whatever reason, gaming real estate assets have not priced in the same way. Cap rates have remained stubbornly high even as interest rates fell. This makes gaming assets the last bastion of widespread high cap rates in private real estate transactions.

Why this represents mispricing

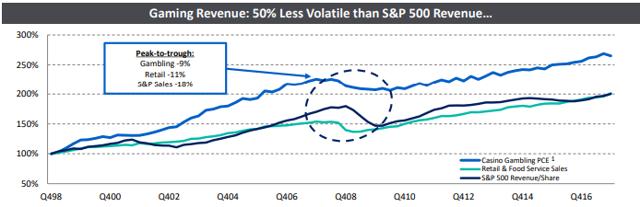

One may make the argument that gaming assets trade at higher cap rates due to the boom and bust nature of casinos. Intuitively, I would have thought this was true, but the data does not back this idea up. In fact, gaming revenues declined less through the Great Recession than the revenues of the broader economy.

Source: VICI

Why might this be?

Gambling is a luxury expense, so one may think it would be the first thing people would stop spending on during recessions. However, there are countercyclical elements that offset the cyclical demand drivers.

- Gaming can be very local. Those on a budget may forgo travel and just take a trip to their local Ho-Chunk casino instead.

- Vegas is a travel hub. Flights to Vegas are often around $100 making it among the cheapest destinations for those who travel long distance.

- Gaming is experiential and people are increasingly forgoing expenditure on materials so as to spend money on experiences instead.

In addition to gaming revenues seeming to be resilient through rough economies, I think it is important to note that casinos are essentially Amazon (AMZN) proof. Other classes of real estate that are resistant to Amazon are trading at very low cap rates, yet gaming RE trades in the private market at 7% to 10% cap rates.

I believe this is clear mispricing and VICI Properties is best positioned to take advantage with massive acquisitions in progress as well as a restocked pipeline.

In-progress acquisitions

On June 17th, VICI entered into an agreement to buy three resort/casino assets from Eldorado Resorts (ERI). The purchase price of $278mm represents a roughly 9% cap rate on the $25mm of annual revenue on the 15-year lease.

VICI's cost of capital is far south of 9%. Their equity cost of capital is about 7% and they can borrow at about 5% for a WACC just north of 6%. Thus, we see the deal as quite accretive with a healthy spread of nearly 300 basis points. It is expected to close in the first quarter of 2020.

Eldorado is incented to sell off some assets to satisfy anti-trust in conjunction with its merger with Caesars Entertainment (CZR). This batch of 3 resorts was its small sale. The large batch also went to VICI.

On June 24th, VICI agreed to acquire the land and real estate associated with Harrah's properties in New Orleans, Laughlin, and Atlantic City for a total of $3.2B. As part of the deal, VICI and Caesars are modifying and extending their existing lease agreement which will add $252.5mm in incremental annual rent. This approximates a 7.9% cap rate.

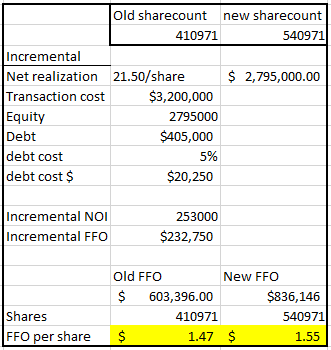

To pay for this sizable acquisition, VICI issued 115mm shares plus an additional 15mm through the greenshoe. We ran the numbers below to see how this would impact the bottom line.

Source: Author generated using data from company press releases and SNL Financial

8 cents of accretion is nice, but the bigger benefit is that this deal was almost entirely equity. $2.795B of the $3.2B was funded through the equity raised which means it will be significantly leverage reducing for VICI. After the deal, VICI will have substantially less than 30% debt to capital which will free up the balance sheet for extensive additional purchases.

As part of this transaction, VICI was granted ROFRs on any 2 of the following Las Vegas strip assets:

- the Flamingo Las Vegas

- Paris Las Vegas

- Planet Hollywood

- Bally's Las Vegas gaming facilities

- Linq gaming facility

VICI also got a ROFR on the Horseshoe Baltimore.

With these ROFRs in place, VICI has a fully stocked acquisition pipeline going forward. There is the potential that this acquisition falls through due to a failure of ERI to close its merger with Caesars, but VICI is partially protected by a $75mm termination fee per the merger 8-K.

If the ERI/CEC Merger does not close for any reason, under certain circumstances, ERI may be obligated to pay the Company a termination fee of $75.0 million."

Primary risk

VICI has all its eggs in one basket. Caesars, soon ERI, is responsible for the vast majority of VICI's revenues, so it is imperative that ERI stays afloat so as to honor the 15-year lease they have with VICI. Let us take a look at the financial condition of ERI to ascertain the magnitude of this risk.

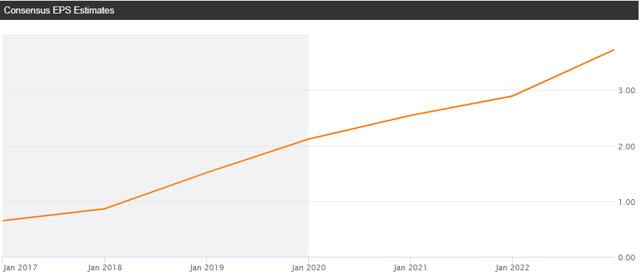

Eldorado Resorts has a strong track record as a public company of creating shareholder value.

Source: SA

Since late 2014, the stock has gone from well under $10 to $45 today. The favorable trajectory looks to continue going forward with Street estimates showing substantial EPS growth through 2023.

Source: SA

S&P Global ratings estimates that post-merger, debt to EBITDA of ERI will be in the 7-8x range which is fairly high. I suspect it will come in slightly lower due to the volume of dispositions that ERI has completed in anticipation of the merger.

Overall, we are watching closely due to the high leverage but are comforted by ERI's strong track record and substantial size.

Valuation

With the estimated $1.55 of FFO/share post-merger, VICI is trading at about 14.3x. This puts it roughly in line with casino REIT peers.

Source: SNL Financial

I believe VICI should trade at a premium to peers for 2 reasons.

- VICI has an exceptional acquisition pipeline as we discussed earlier

- VICI has a longer WALT

For triple net lease REITs, much of the risk is concentrated at lease turnover. Re-leasing can be very expensive in terms of commissions or capex and there is always risk of rent cuts or vacancy. VICI has significantly mitigated this risk by achieving a full 15-year WALT on nearly all of their revenue due to the renegotiation with Caesars related to the recent $3.2B acquisition.

With such a long WALT, VICI's revenues are positioned to grow organically by 1.5% annually (from escalators) for 15 years. That sort of stability usually trades at a premium and we see 16x being the fair value multiple for VICI ($24.80).

This would place it at a premium to casino REIT peers but still a discount to most of the triple net REITs.

Temporary buying opportunity

VICI has generally tracked with the REIT index in terms of pricing performance, but it has recently fallen behind due to a massive equity offering related to the aforementioned $3.2B acquisition. Notice the gap at the right side of this chart.

Source: SNL Financial

Even though the acquisition is broadly considered to be accretive on a per share basis, it can be challenging for the market to absorb 130mm new shares. The influx of supply has overwhelmed the buyers and caused downward pressure on the share price. We see this as an opportunity to get in.

Once the shares are absorbed, we anticipate a springback to above where VICI was trading. The springback should be a combination of making up lost ground from the issuance related dip and a pricing in of the accretion of the acquisition. This springback could close a good portion of the 10% delta to fair value.

Disclosure: 2nd Market Capital and its affiliated accounts are long VICI. I am personally long VICI. This article is provided for informational purposes only. It is not a recommendation to buy or sell any security and is strictly the opinion of the writer. Information contained in this article is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions. Dane Bowler is an investment advisor representative of 2MCAC, a Wisconsin registered investment advisor. Commentary may contain forward-looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article. Positive comments made by others should not be construed as an endorsement of the writer's abilities as an investment advisor representative.

Conflicts of Interest. We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients' interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.