Shares of healthcare giant Abbott (NYSE:ABT) remains in an uptrend trajectory this year after posting Q2 2019 financial results on July 17 that slightly missed revenue but beat EPS and raised the full-year 2019 outlook, based on the positive prospects across its businesses lines.

I consider that investors' bullish sentiment on the stock is largely justified as the company features a diversified pipeline of new products in very attractive areas, such as structural heart, diabetes care and diagnostics, building a foundation for a sustainable top-tier growth and solid shares price performance over time.

Source: Tradingview

Background and Business Outlook

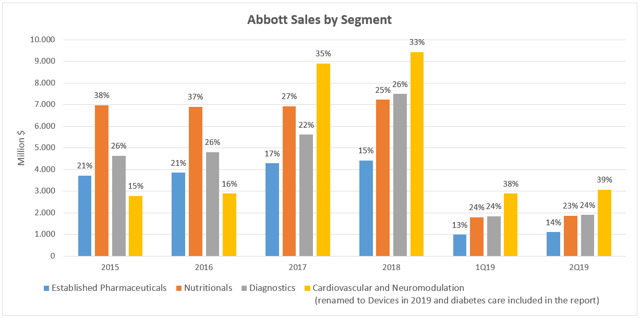

After having carried out a strategic business shift through the acquisition of St. Jude Medical and Alere occurred in 2017, Abbott has significantly advanced its presence in long-term growth areas such as diagnostics and cardiovascular medical devices. The chart below illustrates the increasing participation of these areas in Abbott overall business.

Source: Company's fillings, summarized by the author

As a remark, the Devices segment was formed in 2019 by the consolidation of Cardiovascular and Neromodulation with Diabetes Care business. In this new area there are several key growth drivers for the company, as highlighted below:

MitraClip: It is a market leading device for treatment of mitral regurgitation, a highly underpenetrated market. FDA has recently approved the fourth generation of this device with new options when treating mitral valve disease. In Q2 2019, it had global sales growth of more than 30%. Furthermore, FDA approval in March 2019 for an expanded indication addresses the secondary form of mitral regurgitation and increases the amount of people that can potentially be treated with MitraClip.

FreeStyle Libre: It is a continuous glucose monitoring system for patients with diabetes, which doesn't require a finger stick. With diabetes affecting more than 80 million people around the world, Abbott targets this product