Charles Schwab (NYSE:SCHW) is a leading US investment advisor/management company with a healthy mix of the retail and institutional advisory business. It has $3.7T AUM through which it generates around $3.5-4B net income.

Through the USAA deal, Schwab should be well-equipped to maintain its growth trajectory over the coming years with $7B in additional cash deposits from USAA, cross-selling opportunities, and strengthened leadership positions in the multiple business segments that it serves. Not that Schwab needs it - the company is already an established brand and is considered among the best brokerage services in the US with partnerships/business entities across the globe.

As a Schwab shareholder, I believe this transaction will prove value-accretive over the medium to long term as a result of the achievable, yet sizable, synergy targets and the company's strengthened competitive position as a result of the deal.

Though there are risks in the short- to medium-term, Schwab looks well-positioned for the long run. On valuation, the company may look expensive compared to its peers, but I'd argue the valuation is justified on account of the company's competitive advantages and strategic positioning within its sector.

The USAA Acquisition

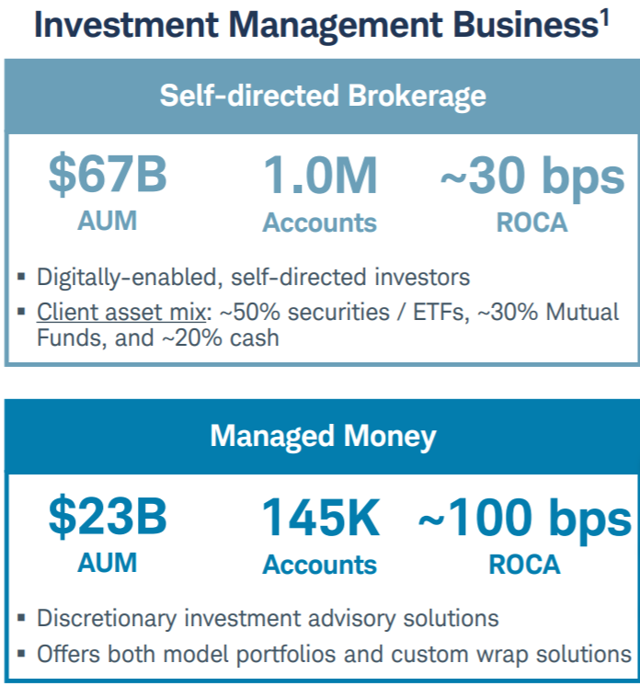

Charles Schwab recently announced the acquisition of USAA's investment management business, a diversified financial services company catering to the financial needs of current and retired US military personnel and their families. Through the deal, Schwab will acquire ~$90B assets under management of ~1.2M customers. Schwab will immediately obtain ~$7B worth of customer cash lying in USAA's accounts when the deal gets completed, which is expected sometime around Q2-Q3 2020.

(Source: pg 4 of Schwab's Investor Presentation)

Schwab expects $130M in revenue synergies and $100M in expense synergies on an annualized basis from this acquisition. The expected sources of revenue synergies - the migration of cash to Schwab from USAA and incremental opportunities to