I last wrote about Insulet (NASDAQ:PODD) on February 9, 2014. At that time, the Bedford, MA company was trading at $43.00 per share and had a market capitalization of $2.35 billion. I hope you read my article on the company back then.

Insulet is currently one of the 17 stocks that I own in my Ultra-Growth portfolio. This portfolio is up over 35% YTD.

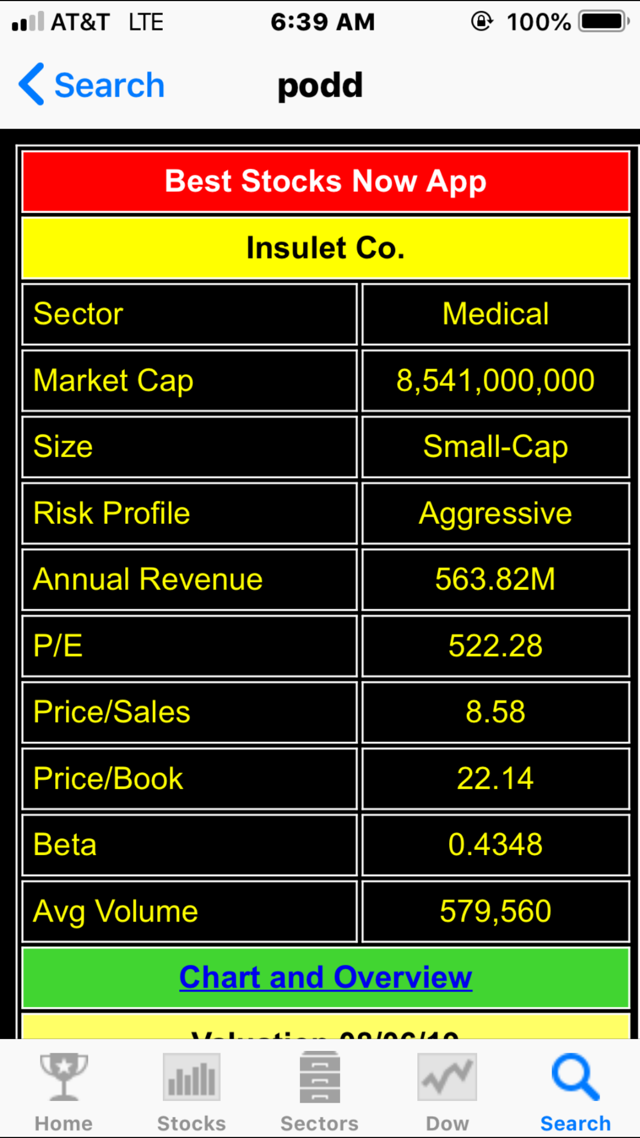

Insulet reported a blowout quarter this past week, and the stock broke out to a new high of $143.13 per share. Insulet now has a market capitalization of $8.54 billion.

The stock first grabbed my attention when it showed up as the number one ranked stock in my proprietary database back in November of 2013. Here is a screenshot from my February 2013 article.

Data from Best Stocks Now Database

The company was formed in 2000 by a loving father searching for a cure for his diabetic son. Along the way, they developed a wireless, handheld insulin infusion system for people with insulin-dependent diabetes.

Type 1 diabetes already affects more than 37,000 people worldwide. This number continues to grow. What does it mean for these millions of sufferers?

Significantly increased chance of stroke and heart failure as well as a shortened lifespan of up to ten years. You more than likely know someone suffering from this disease.

Let's take another look at this fast-growing, ultra-growth stock.

Data from Best Stocks Now Database

As I mentioned, previously, Insulet has now grown to a market capitalization of $8.54B. It is still a small-cap stock. I have it in a profile that best suits aggressive growth investors.

The current PE ratio has little significance, as the company just recently crossed over the profitability line. Annual sales have now grown to $563M, they were at just $235M when I last wrote about the company.

Losing sleep over your stock portfolio? Maybe you are not buying Best Stocks Now. These have both momentum and valuations with 80% or more upside potential.

Bill Gunderson has been a professional money manager for 22 years. He is seeking alpha daily in the market for you.

Subscribers get access to Bill's database of 5,300 stocks, funds, and ETFs, live trading alerts, and a weekly in-depth, market-timing newsletter with 4 portfolios. This will jump-start your quest to reclaim those Zs and alpha!

From Dividend to Emerging Growth portfolios, Bill has you covered.

Click here for a free trial of Bill Gunderson's Best Stocks Now service.