Overview

Being the smaller one among its competitors such as Bloomberg or Thomson Reuters (TRI), we think that FactSet (NYSE:FDS) presents a very interesting investment opportunity given its very strong product, business fundamentals, and financial performance to-date. One thing that we like in particular about FactSet is its core product, where its flexibility and specialty has allowed FactSet to both cross-sell and provide a stronger niche offering for a more specialized type of users such as wealth manager and data scientists, outside the traditional users such as portfolio managers or equity researchers.

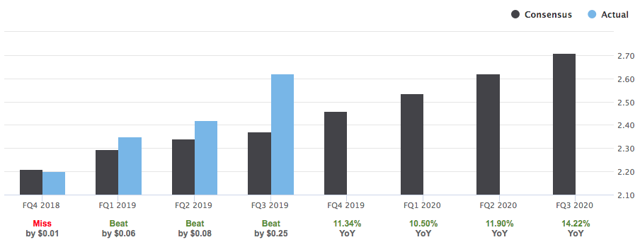

(Source: Seeking Alpha. FactSet’s EPS estimation vs actual)

So far, FactSet has had a very strong year. After 3 quarters of solid EPS beats combined with a very exceptional Q3 2019 performance where its EPS grew by 24% YoY, we think that it would be quite likely for FactSet to outdo the analysts’ projected annual revenue of $1.43 billion at the end of August, which is the end of its fiscal year for 2019. The relatively more conservative performance guidance would bring its annual revenue growth rate to 5.9% YoY, slightly lower than its 6.4% Trailing Annual.

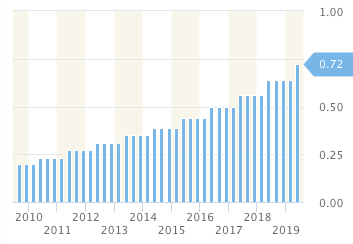

(Source: Stockrow. FactSet Dividend per share)

Another reason why a lot of mainstream and income investors choose FactSet is due to its dividend and shares buyback policy. Over the last few years, FactSet has maintained a steady 12.5% DPS YoY growth, which in its case creates further confidence in the stock resulting in a strong price per share performance.

Strategy: Rewards for playing to its strength

As we have mentioned briefly, we think that FactSet’s strength is in the modularity of its product. Compared to an older generation financial data provider such as Bloomberg, FactSet’s array of products and services can cater to different audiences such as wealth managers, risk analysts, or investment researchers separately as