Planet Fitness Inc. (NYSE:PLNT) has become something of a stock market juggernaut, up 370% since its 2016 IPO. The national chain of no-frills gyms and fitness centers continues to impress with steady growth and increasing profitability. The differentiation of the brand is an industry-leading low monthly membership fee from $10 which is made possible as the locations typically only feature workout equipment to maximize space with limited amenities. Planet Fitness now has 14 million members across 1,859 locations. The core business of selling gym members may seem simple, but a deep dive here uncovers a complex business model with a number of moving parts in an overall intriguing growth story. This article recaps the latest Q2 earnings and our view on where the stock is headed next.

PLNT stock price chart. Source: FinViz.com

Q2 Earnings Recap

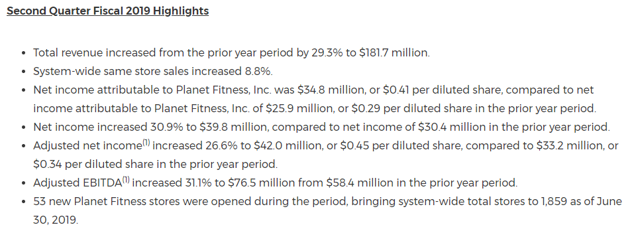

Planet Fitness reported Q2 revenue of $181.66 million, up 29% y/y and exceeding consensus estimates by $13.75 million. EPS of $0.45 also beat estimates by $0.04. It was a solid quarter for the company with system-wide same-store sales increasing 8.8%. The company has now reported 50 consecutive quarters of positive same-store-sales. Higher margins are a theme with the operating margin increasing 120 basis points to 35.9% from last year.

PLNT Q2 earnings highlights. Source: Company IR

Management increased forward guidance including for more stores while boosting the full year revenue forecast to 18% from a previous 15%. From the conference call:

Now to our full year 2019 outlook. For the year ended December 31, 2019, we are adjusting our guidance as follows: total new store equipment sales will be in the range of 250 to 260 new stores, up from approximately 225, including approximately 25 international new equipment sales. Same store sales will be approximately 8% in line with our previous guidance of high-single-digits. Total revenue will increase by approximately 18%, up from approximately