Nutanix, Inc. (NASDAQ:NTNX) is one of the most beaten-up SaaS companies that I follow. The stock that sported a $65 share price a little over a year ago now trades under $20. It is quite conceivable that Nutanix stock could reach its all-time low of $15 before any kind of rebound occurs, especially if SaaS stocks continue to deflate as they have been in the recent past.

(Source: Yahoo Finance/MS Excel)

While Nutanix is severely oversold at this time, I have some difficulty considering this as a buying opportunity. Sales growth has fallen dramatically over the last two years, from 85% to 12% TTM. The deceleration in growth can partially be explained away by the company's transition to a subscription-based model and poor sales execution, but I'm not convinced that Nutanix is going to turn on a dime, certainly not this year at least.

The company fails the Rule of 40 and has very excessive SG&A expenses that I have a hard time justifying based on financial performance. Therefore, I give Nutanix a neutral rating with the intent of revisiting this stock later in the year. If the stock forms a base and revenue growth returns, then it might be worth buying some stock as a speculative play.

Stock Valuation

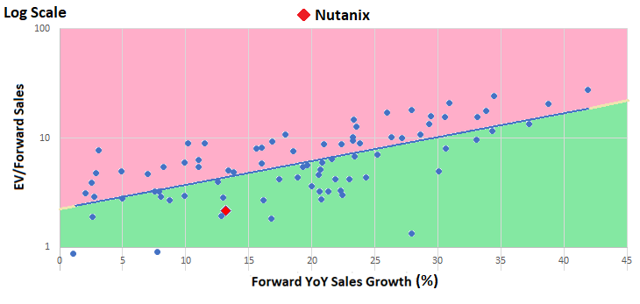

I determine stock valuation on a relative basis by comparing sales multiples and sales growth to the company's peers. I believe that high-growth companies should be more highly valued than slow-growth companies. After all, growth is a prime factor in valuation models such as DCF. Higher future growth results in higher valuation and, therefore, higher EV/sales multiple.

To illustrate this point, I created a scatter plot of forward gross profit/enterprise value versus estimated YoY sales growth for the 82 stocks in my digital transformation stock universe.

(Source: Portfolio123/MS Excel)

The