Looking at the earnings multiple on Under Armour (NYSE:UAA) (NYSE:UA) would give value investors a heart attack, but looking at the cash flow per share valuation leaves the stock much more appealing to valuation sensitive investors.

After Under Armour reported 2nd quarter financial results on the morning of July 30th, 2019, Telsey Advisory Group (TAG) noted that the North American revenue miss (down 3% y/y vs. the smaller miss expected) and the lack of any boost in 2019 guidance left them reiterating their $25 price target per Briefing.com.

Here is where reviewing the numbers after earnings left me thinking:

Positives:

1.) Cash flow and free cash flow continued to improve, and with the stock trading at 59x expected 2019 EPS of $0.34, it looks very expensive, but on a cash flow valuation, the stock is trading at 15x and 20x cash flow and free cash flow, respectively.

2.) While North American revenue fell low single digits for the 4th consecutive quarter, North American operating income at $139 million grew y/y for the 2nd consecutive quarter, at 5% (+8% in the March 2019 quarter).

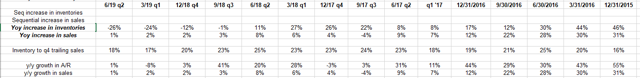

3.) Inventory is being slashed and has fallen dramatically the last 4 quarters - here is what the history looks like:

Source: modeling sheet from earnings reports

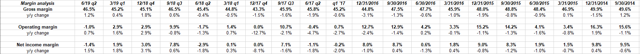

4.) Gross margin continues to improve. After bottoming at 43%-44%, here is the table history:

3.) Footwear revenue grew 5% y/y as HOVR continues to do well. Total Apparel revenue fell 1% y/y and is 62% of the Under Armour total revenue while Footwear is 24% of total revenue. Footwear's improvement is important, but Apparel improvement is more important.

Negatives:

1.) When this Under Armour earnings preview was written, the stock was up 50% YTD in 2019 but is now up just 14.25% YTD (per Morningstar data). Technically, the stock has traded back below the