The post-earnings performance in shares of DXC Technology (NYSE:DXC) is nothing short of unexpected. DXC fell by one-third and to all-time lows when it cut its full-year guidance. The single-digit P/E and dividend yield of 2.5% is not a selling point for value investors. Should shareholders continue holding DXC? For DIY value investors who waited for a better entry point, is now the time to buy?

DXC reported first-quarter non-GAAP earnings of $1.74 despite revenue falling 7.4% to $4.89 billion. Delays in a few deals sent the book-to-bill ratio to 0.9 times. Digital revenue came in even stronger, growing 35% Y/Y and lifting the book-to-bill to 3 times. Management is confident that the Luxoft acquisition will strengthen its digital offerings. It strengthened its relationship with Microsoft (MSFT) through a joint Microsoft Azure digital transformation practice together with DXC. A partnership with Alphabet's (GOOG) Google Cloud will further broaden the pair's digital solution offerings.

These partnership developments failed to impress investors and run contrary to DXC's lowered outlook. The company now forecasts revenue in the range of $20.2-20.7 billion, below the previous $20.7-21.2 billion. EPS will be $7.00-7.75, sharply lower than the previous guidance of $7.75-8.50. Growth of its cloud infrastructure, up 36% Y/Y, may not be enough to offset the slowing traditional infrastructure business. DXC blamed high client workload costs from legacy environments hurting the outlook. Such stranded costs are taking longer to work through than DXC previously expected.

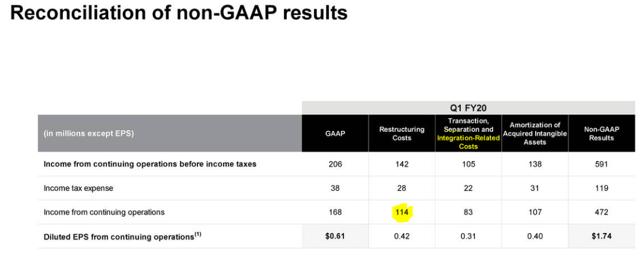

Staff automation initiatives are also taking longer to implement. The Bionix automation program, which reduces headcount. To get a better view on what is pulling DXC's quarter lower, look at the non-GAAP to GAAP reconciliation in the first quarter:

Source: DXC Technology

Restructuring and transaction, separation, and integration-related costs hurt earnings and may continue to do so for the rest of the year. Investors, who

Please [+]Follow me for coverage on deeply-discounted, busted companies. Click on the "follow" button beside my name.

Also, for a limited time, I am inviting you to get started on the DIY (do-it-yourself) value investing.