Investment Thesis

Tencent Music Entertainment Group (NYSE: NYSE:TME) reported Q2 results for 2019, maintaining fast growth on paying users as well as total revenue. Our projection implies a bottom line growth rate of 20% over the next 4 quarters, which makes TME a good target as a growth stock.

Q2 Earnings Show Continuous Growth

TME released its Q2 earnings results on Aug 12th. The results show continuous growth in both business scale and revenues:

- Business operation: Online music paying users reached a record 31.0 million, an increase of 33.0% year-over-year. This represents a paying ratio (paying uses over MAU) at 4.75% which is historical high. Paying users for social entertainment services reached 11.1 million, a 16.8% growth rate yoy;

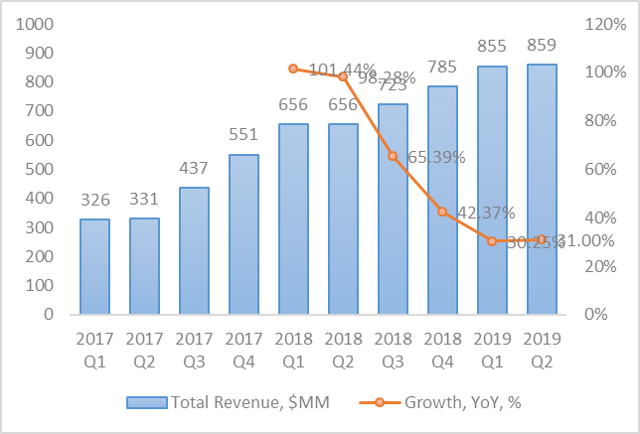

- Revenues: Total revenues for the second quarter of 2019 increased by RMB1.40 billion, or 31.0%, to RMB5.90 billion (US$859 million). Revenues from online music services for the second quarter of 2019 increased by 20.2% to RMB1.56 billion (US$228 million), and revenues from social entertainment services and others for the second quarter of 2019 increased by 35.3% to RMB4.34 billion (US$632 million);

- Profitability: Gross profit for the second quarter of 2019 increased by 8.1% to RMB1.94 billion (US$283 million), representing a gross margin of 32.9%. Operating expenses as a percentage of total revenues was 17.8% in Q2 2019, compared to 18.5% in the same period of 2018. Net profit was RMB927 million (US$135 million), leading to basic and diluted earnings per American Depositary Shares ("ADS") of RMB0.57 (US$0.08) and RMB0.55 (US$0.08), respectively.

Although the growth rate has been slowing down, TME was still able to achieve over 30% total revenue growth in Q2, marking continuous high growth rate over the past years:

Source: TME's ER

In this article, we want to investigate TME's future growth potential, by looking into the total revenue growth