Ecolab Inc. (NYSE:ECL), headquartered in St. Paul, Minnesota, is an American global provider of water, hygiene and energy technologies and services to the food, energy, healthcare, industrial and hospitality markets.

Lately, I've been tracking companies that rank higher on various ESG guidelines. ESG refers to the three central factors in measuring the sustainability and ethical impact of an investment in a company or business: Environmental, Social and Governance. For instance, Ecolab is the 2nd biggest position (after Microsoft) in the MSCI USA ESG Select Index. This index is optimized to be sector diversified, targeting companies with high ESG ratings in each sector.

The question is whether these criteria could help to better determine the future financial performance of companies and the potential return for its investors. Let's take a look at Ecolab and discuss whether it can be a good addition to your portfolio at current prices.

Company profile

Ecolab's mission is to deliver safe food, clean water, abundant energy and healthy environments. For instance they sell warewashing equipment for restaurants, food safety solutions to a hotel, energy recovery and process water treatments in plants, foam control products in refineries, etc.

Its client base includes Apple (AAPL) , McDonalds (MCD), Coca-Cola (KO), Shell (RDS.A) (RDS.B), Unilever (UN) and Walmart (WMT) to name just a few. Because of its wide ranging product and service offerings Ecolab is globally diversified and selling to companies from all sorts of sectors. Therefore they are relatively insensitive to specific market fluctuations.

Revenue and earnings

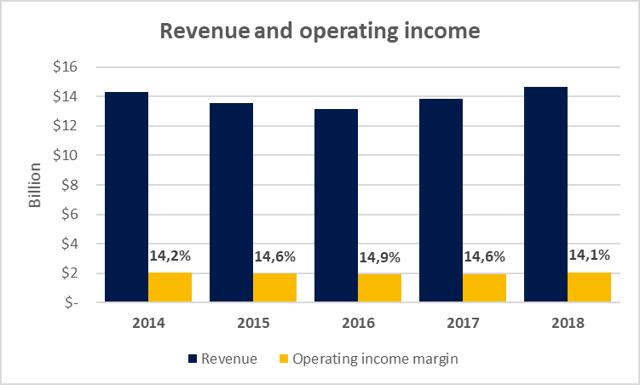

Before I delve into other business fundamentals and valuation questions, let's see how Ecolab has performed during the last years. The figure below shows the revenues and operating income of the company since 2014.

Source: Data from Morningstar, graph created by author

It can be seen that revenues have hardly gone