In this previous article on NVE Corp. (NASDAQ:NVEC), I concluded,

NVE is a great company with a few blemishes (too liquid, slow growing, underleveraged) but many, many opportunities to succeed to a greater degree than it already has. Although I do not currently own shares, I have owned them on and off over the past decade and look forward to owning them again when the share price comes down to levels befitting its present cash flow capacity or when it successfully makes the transition to a fast grower which justifies its current multiples of earnings and cash flow."

Since that article was published, the "spintronics" pioneer has released its first quarter 2020 results (ended June 30, 2019), and the share price has declined more than 10%, which leads us to re-evaluate the company's cash flow capacity and its progress toward faster growth and better multiples.

Revenue Analysis

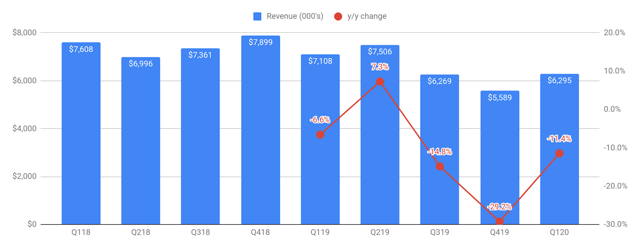

Quarterly revenue was down more than 11% y/y due to 11% and 12% declines in product sales and R&D revenue, respectively. These poor results are certainly not indicative of stepped-up growth, but the rate of y/y decline was improved from Q419 (ended March 31, 2019) and Q319 (ended December 31, 2018). Sequentially, revenue in Q120 grew 12.6% from Q419, which itself had been a second straight quarter of sequential decline. Next quarter's revenue growth will help clarify if revenue growth has perhaps stabilized and is poised to resume an upward trend.

On its Q419 earnings call, the company explained the weak revenue (down 29% y/y) was a result of an expected decrease in custom anti-tamper product sales and a decrease in sales of products for medical devices. However, the company indicated it believed sales of anti-tamper products would pick up next quarter (i.e. Q120), which was an affirmation of the prior Q319 commentary regarding Q120 revenue. Sure enough, the weak product revenue in Q120