Allison Transmission Holdings, Inc. (NYSE:ALSN) looks far from being a company whose core business will be wiped out when electric trucks rule the roads. On the one side, there’s the doom scenario with a certain EV future stacking the odds against the company; on the other, there’s a company that’s been performing exceedingly well on multiple fronts, and an EV truck reality that’s too far into the future to quantify in any meaningful way. For all the reasons outlined below, investors in the auto segment cannot afford to ignore this giant of automatic transmission systems.

Putting aside the far-away threat of electric vehicles not requiring gear systems the way traditional ICE (internal combustion engine) vehicles do, it’s clear that this company can weather the trends that affect the auto market. Here are a few aspects to consider, after which we’ll address the EV issue.

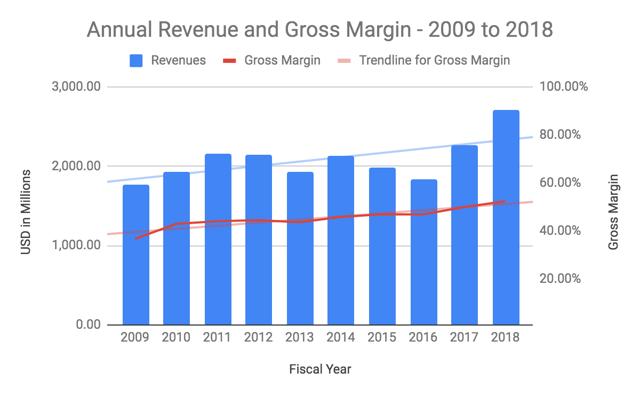

Historical Revenue Growth and Gross Margin Expansion

Revenue growth can hardly be called consistent, but between 2009 and 2018, Allison grew its annual net sales from $1.77 billion to $2.7 billion, or more than 50%. Adding nearly a billion dollars to the top line is not easy when you’re the market leader in a very mature and competitive segment, but Allison was able to do exactly that over the past decade. Admittedly, that growth has come in stops and starts, with four out of five years showing consecutive revenue declines between 2011 and 2016; however, the overall trend lines for both revenue growth and gross margin expansion are undeniably moving upward.

For the first half of 2019, the company posted net sales of $1.4 billion and a gross margin of nearly 53%. The second half is going to be a hard run based on the current geopolitical landscape and its impact on the trucking industry as a whole. More on