Tenaris Can Bounce Back in 2020

Tenaris S.A. (NYSE:TS) is a Luxembourg-based provider of steel pipe products to upstream energy companies across the world. The project deferrals in the offshore energy markets, tariff hikes for steel products, policy uncertainties in Latin America, and the lack of any significant new project are the company’s concerns. Policy uncertainty in some of the Latin American countries can also hinder growth and reduce margins in the short term.

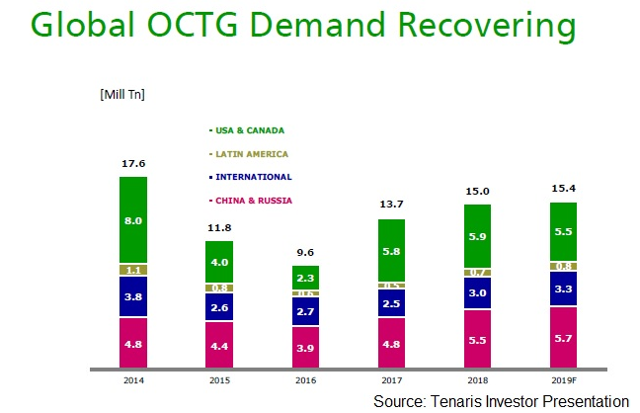

I expect the U.S. market recovery and international markets to drive the company’s growth in the medium term. Tenaris’s Rig Direct services and Dopeless technology are expected to provide a competitive advantage in the medium term. I expect revenues from the Middle East and Europe to grow through 2020 due to higher LNG export possibilities. Tenaris has negative net debt, which is a big plus for a company of this size.

Analyzing Financial Performance

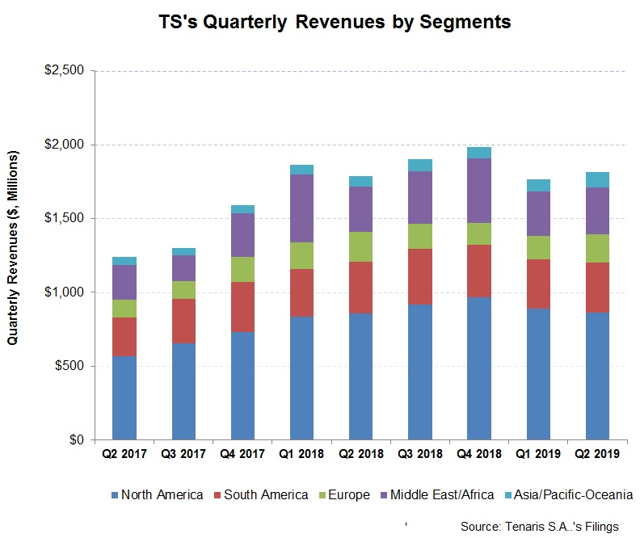

In Q2 2019, Tenaris’s top line strengthened, while the bottom line improved compared to Q1 2019. On a year-over-year basis, its performance remained steady. From Q2 2018 to Q2 2019, the company's revenues increased by 2%, while the net income fell marginally. Geographically, revenues from the Asia/Pacific-Oceania region increased the most, with a ~30% quarter-over-quarter rise, followed by Europe (23% up sequentially).

However, revenues from North America decreased (3.4% down sequentially). At the operating profit level, the company’s margin squeezed by 1.6% due to higher maintenance costs, while a quarter ago, its margin benefited from $15 million tariff recovery.

Opportunities In The International Market

The company has increasingly focused on the Middle East market in the past few quarters. Many energy operators in the Middle East (including Saudi Arabia, UAE, and Kuwait) are pursuing a strategy of increasing natural gas in the production mix as they target higher export. Qatar, in particular, is ramping up for drilling in the North

The Daily Drilling Report

We hope you have enjoyed this Free article from the Daily Drilling Report Marketplace service. If you have been thinking about subscribing after reading past articles, it may be time for you to act.

Good news for new subscribers! In May we are offering a 10% discount off the annual subscription rate of $595.00

Give it some thought, and act soon if you are interested. A 2-week free trial is applicable, so you risk nothing. Hope to see you in the DDR as we look for bargains in the oil patch!