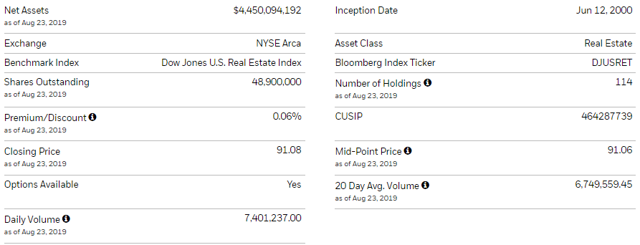

iShares U.S. Real Estate ETF (NYSE:IYR) is one of the largest domestic real estate and REIT-focused exchange traded funds with total assets under management of $4.5 billion. REITs have been exceptionally strong in 2019 with IYR up 23% year to date on a total return basis compared to 15% for the S&P 500 (SPY). That outperformance is in part based on a market trend favoring dividend-paying stocks with a perception of safe payouts, considering emerging concerns over the strength of the economy. There is an understanding that REITs should be more resilient in a potential cyclical downturn.

(Source: FinViz.com)

Separately, "tech-REITs" including firms that own and lease cell towers along with some data center names have been among the biggest winners in IYR this year, boosting the entire fund. This article highlights some of the trends in IYR, including the performance and valuation metrics for the underlying holdings along with our view on where the fund is headed next.

IYR Key Stats. source: iShares

IYR Underlying Performance

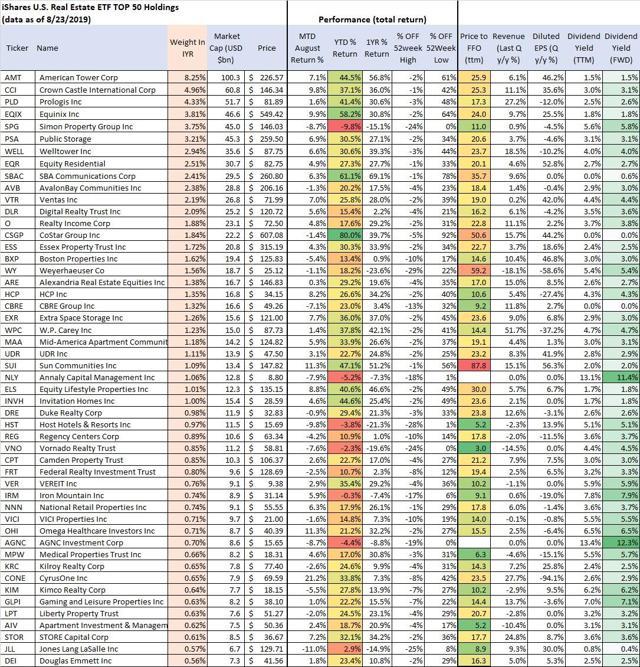

The table below includes selected metrics for the top 50 holdings of IYR. As mentioned, IYR is up 23% year to date while the average stock among 114 holdings in the entire fund is up 17%. Only 20 stocks have presented a negative return this year. The fund's performance has benefited from the relative strength of its top holdings.

IYR Top 50 Holdings Performance. Source: data by YCharts/ table author

CoStar Group, Inc. (CSGP), a provider of real estate listings and analytics information through a portfolio of brands including Apartments.com, is the biggest winner, up 80% in 2019. The company last reported revenue growth of 16% in the last quarter while the full year EPS consensus estimate is 23% higher from 2018. CSGP is classified as real estate services and not structured as a REIT. While most