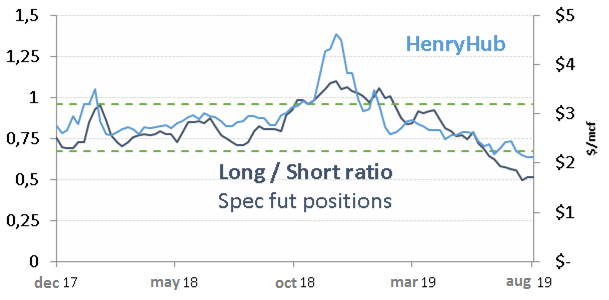

Cabot Oil & Gas (COG) started recovering two weeks ago when concerns about natural gas market and trade tensions were at the most high level. It is a positive sign that investors apart from me are interested in this undervalued and attractive gassy company. The positioning in natural gas futures is extremely bearish. The likelihood of natural gas price to recover by the winter looks attractive enough to invest in the company.

Long speculative positions are at very low levels relative to the shorts.

Source: CFTC, Bloomberg

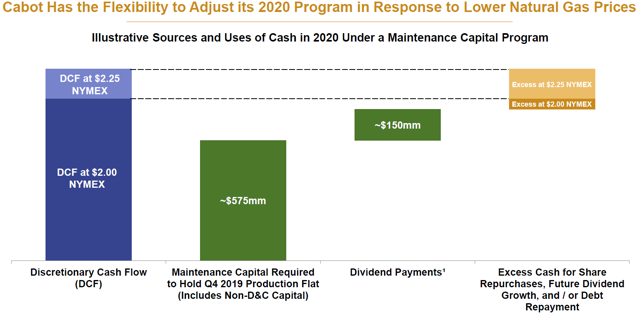

Cabot's shares have fallen so bad lately because of the 2Q19 earnings report and the 2020 guidance. The management announced a 5% production growth in 2020 without a reduction in capital expenditures. Market's reaction could have been better, had the management focused on the flexibility of their capital program. At the next conference on August 16, the new slide appeared in the company's investor presentation with the number for maintenance capital expenditures ($575m). The slide also illustrates how the company could cover its dividend payments even at current natural gas prices.

Source: Cabot Oil & Gas - 2019 Enercom Conference

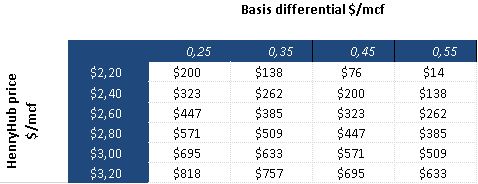

Mentioned in the slide maintenance CapEx above $500m looks justified. The guidance for CapEx program next year is $700-725m. Free cash flow is very sensitive to natural gas prices. My forecast for the next year is $2.9 per MMBtu and FCF yield accordingly is at the 8% level. The company has got a strategy to pay shareholders about half of the free cash flow.

COG's FCF 2020 forecast sensitivity

Source: Estimates

Risk-off sentiment enhanced the negative reaction to the company's earnings results. Investors had become very concerned about lowering economic growth. This year investors have been looking for defensive assets. Volatility in the markets surged. It was not the best time for high-beta companies to show negative