Company overview

Star Bulk Carriers (NASDAQ:SBLK) is a US-listed dry bulk shipping company with 120 vessels with an average age of 7.8 years. In the last twelve months, the company has spent $1.1 billion buying ships at depressed valuations, which can deliver tremendous value if rates run when IMO 2020 takes effect.

Investment thesis

SBLK's aggressive take on scrubbers (104 ships fitted with scrubbers at the end of 2019), combined with the fleet ampliation the company has achieved during this last year, can provide tremendous value if the spread between HSFO and VLSFO or other compliant fuels like marine gasoil is high, providing the company with a premium to average market rates.

IMO 2020

IMO 2020 is an International Maritime Organization (IMO) regulation that will limit the amount of sulfur in fuel used by shippers to about 0.5% from 3.5% (by weight) when it takes effect January 1, 2020. The 3.5% limit was established in 2012, reducing it from 4.5%.

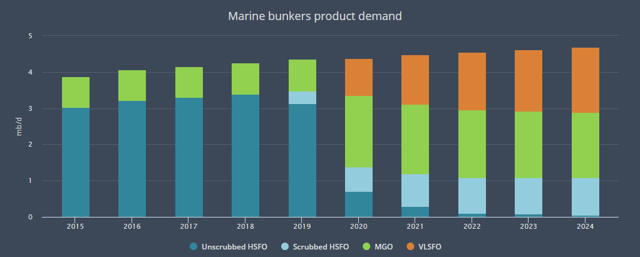

Source: International Energy Agency (IEA) Oil 2019 report

As we can see above, the IEA expects HSFO usage to fall by about 60% while the usage of MGO (marine gasoil) and VLSFO (very light sulfur fuel oil) will skyrocket. This image illustrates what the IEA expects for the whole world (we can see they expect about 750,000 mb/d of unscrubbed HSFO usage suggesting some maritime companies will decide to not comply with the new regulation).

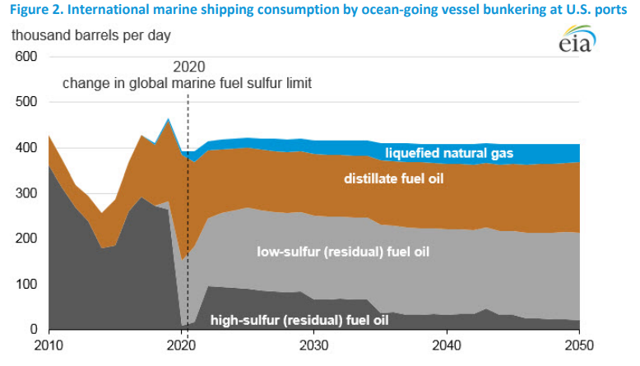

The EIA expects about total compliance with the new regulation (at U.S. ports, it does not make worldwide forecasts). The most interesting considerations from this illustration are the gradual acceptation of liquefied natural gas (LNG) as power for the shipping industry and the adoption of scrubbers