With product candidates acquired from AstraZeneca (AZN) and MedImmune, Viela Bio (VIE) is clinical-stage biotechnology to be followed carefully. Besides, at Phase 3 of development, the company could deliver positive results in 2020, which may make the share price run. After the IPO, we expect Viela to have an enterprise value between $180 and $310 million. With that, in our opinion, savvy individuals will try to acquire shares at an enterprise value of $200 million.

Source: S-1

Source: S-1

Business And Leading Product Candidates

Founded in 2017, Viela Bio is a clinical-stage biotechnology focused on the development of treatments for autoimmune and severe inflammatory diseases.

Source: Company’s Website

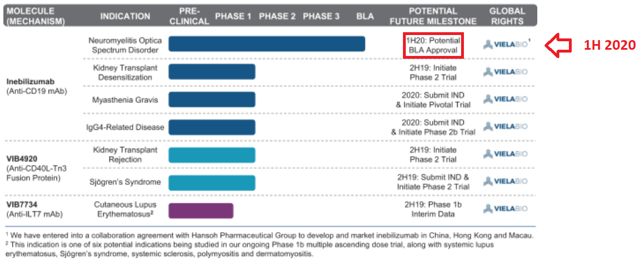

The company’s pipeline will most likely interest market participants. With one product candidate at Phase 3 and other product candidate at Phase 2, Viela is not at an early stage of development. See the company’s pipeline in the image below:

Source: Company’s Website

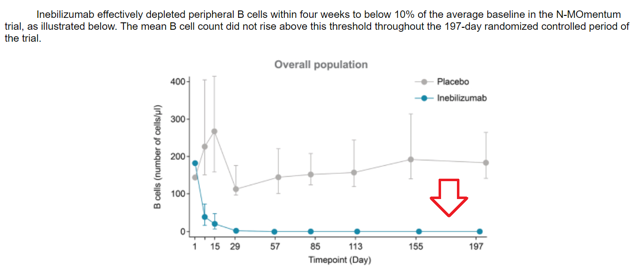

Let’s review the most exciting product candidate. Inebilizumab, a treatment for patients suffering from Neuromyelitis Optica Spectrum Disorders (“NMOSD”), at Phase 3 of development, is an antibody designed to target the molecule CD19. In January 2019, the company reported positive results from a N-MOmentum pivotal trial, which were published in the American Academy of Neurology:

Source: American Academy of Neurology

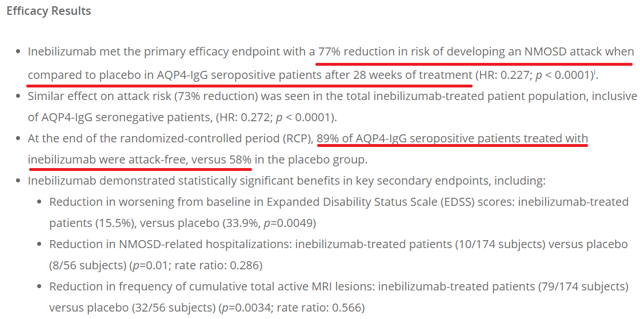

As shown in the lines below, the company obtained 77% reduction in the risk of developing Neuromyelitis Optica Spectrum Disorders as compared to patients treated with placebo. Besides, 89% of the patients who received the company’s treatment were attack-free as compared to patients treated with placebo.

Source: Press Release

Source: S-1

The company notes in the S-1 filing that Inebilizumab was “generally” well-tolerated. The number of adverse events were comparable to those obtained with placebo. Adverse events were reported in more than 71% of the patients. While the amount of adverse events appears to be