Texas Pacific Land (NYSE:TPL) is not like any other company. It generates income from land in order to slowly liquidate itself by buying back its outstanding shares. We see a number of reasons to be bullish on TPL:

- Increased tension in the Middle East and a return of the risk premium in oil.

- Rising shale prospects in general, Texas Permian in particular.

- A truce in the proxy fight.

Texas Pacific Land is one of the oldest and most interesting companies listed on the NYSE. The story has been told here on SA numerous times (see for instance the latest well written addition from SA contributor Joseph L. Shaefer) so we can be brief:

- Through a curious history, TPL owns a large acreage (7,683 square miles) in Texas.

- Apart from selling off land from time to time, the company generates multiple sources of income stream from these holdings:

- Oil and gas royalties.

- Easements and other surface-related income.

- Water sales and royalties.

Until fairly recently, the company didn't really operate much as its main task was to collect the "rent" and distribute this in the form of dividend or (more prominently) slowly liquidate the company through share buybacks.

The latter in particular seemed like a winning proposition, especially when oil and gas royalties exploded as a result of the shale revolution in general and the Permian basin in Texas in particular.

The prospect was for the company to generate ever increasing cash flow with which to buy back ever more shares. This seemed like a win-win situation, and indeed:

The share price was just reflecting progress on the ground:

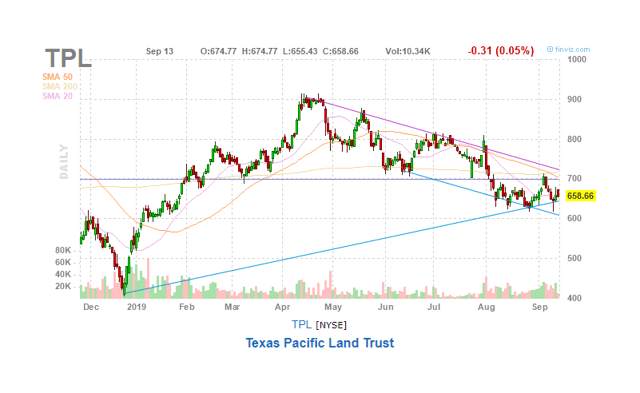

But lately that progress has become somewhat interrupted, and the shares have become quite volatile with substantial swings between $400 and $900:

Oil price

This seems mostly a function of swings