Investment thesis

On Wednesday (September 16), Corning's (NYSE:GLW) shares declined 9.6% after cutting its full-year earnings guidance. At today’s market price of $27.90, shares are down 20% over the last 12 months.

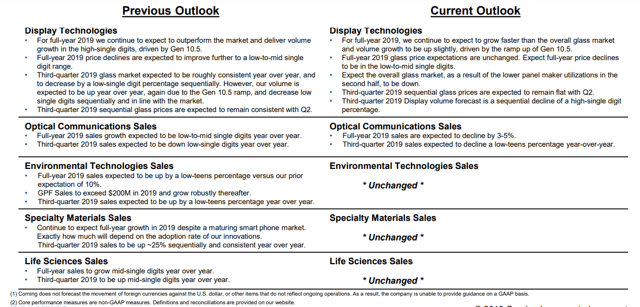

Previous outlook VS current outlook

(Source – Company filings)

The guidance has changed materially for both the display technologies segment and the optical communications sales segment. These 2 segments accounted for 65% of Corning’s revenue in Q2 2019. The reason behind this revised guidance is the new expectations of the company management regarding spending patterns of consumers and the demand for the company’s products.

Despite the expected headwinds in the short term, I find Corning's shares undervalued with an upside of 14% under conservative assumptions.

Company overview & business strategy

Corning is a supplier of advanced glass substrates used in LCDs, optical fiber, ceramic substrates, and a variety of other materials science products. Corning’s markets include optical communications, consumer electronics, display technology, automotive, and life sciences vessels. The major products of the company are damage-resistant cover glass for mobile devices, precision glass for advanced displays, optical fiber products, and wireless technology solutions. Headquartered in New York, Corning’s operations span across the globe.

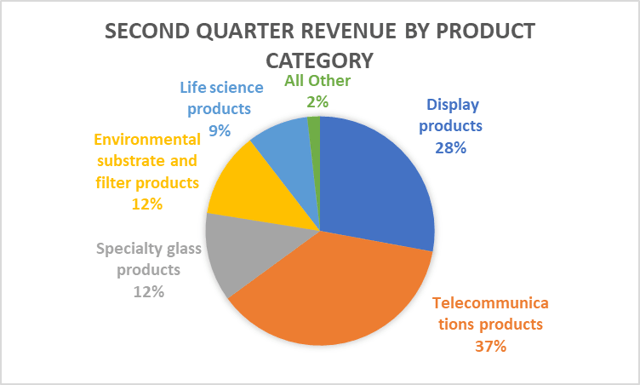

The company derives its revenues from 5 primary business segments.

- Display products

- Telecommunications products

- Specialty glass products

- Environmental substrate and filter products

- Life science products

(Source – Data from company filings)

A slowdown in the top 2 business segments of Corning should end up in a valuation revision and a downgrade as the impact of such a slowdown will be material to company earnings.

Industry analysis

As a leading producer of fiber optic cables, Corning is poised to benefit from the ongoing transformation from copper cables to fiber cables. Credence Research projects the global fiber optic cable market to grow at a CAGR of 7.2% through