We have been trading Foot Locker (NYSE:FL) for nearly two years, buying in the $40s and selling in the $50-60s, and in the present column, we are revisiting the play as the stock is back teetering around the $40 level.

The stock had begun to rally ahead of earnings but was hit hard by its most recent earnings report, which, from a standalone quarter perspective, was mostly disappointing, slightly missing both the top and bottom line estimates. However, there were some strong positives in the quarter that are being completely ignored by the Street, and we believe that the market will recognize these positives in the coming weeks and revalue the stock higher as we move into the holiday shopping season.

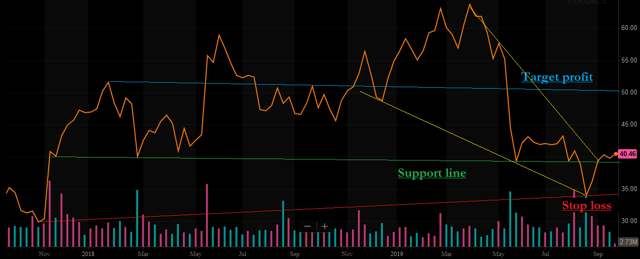

As it stands now, we have a retailer that is struggling with the weight of tariffs. It has done a lot of work to modernize and, as we have discussed many times previously, is working to become a leaner version of itself. Much of any pain is more than priced in here, and we think the biggest risks moving forward here are going to be general market malaise, followed by continued hits to costs from tariffs. There is a growing dividend and some chart support at present levels. We do not buy the story that the company is in danger or is going the way of Blockbuster. The issues it faces are temporary. The longer-term concerns are direct selling by the manufacturer, like Nike (NKE), competition from conglomerates like Amazon (AMZN), and getting foot traffic into stores. Those are real concerns but are priced in with the stock down 40% this year:

Source: BAD BEAT Investing Chartist John R Savage

As you can see in the easy to read chart highlighting our thoughts, Foot Locker stock has been volatile for

We turn losers into winners

Like our thought process on FL? Stop wasting time and join the community of 100's of traders at BAD BEAT Investing.

We're available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week.

- Target entries, profit taking, and stops rooted in technical and fundamental analysis.

- Deep value situations identified through proprietary analysis.

- Stocks, options, trades, dividends and one-on-one portfolio reviews.