Waste Management, Inc. (NYSE:WM) has made significant gains since the beginning of 2019, gaining nearly 30% in that time. Although the year-over-year net income and free cash flow dip in the Q2 2019 earnings report at the end of July exerted some downward pressure on this highly valued stock, it bounced right back up and breached an all-time high of $120 and is currently trading at around $115, mostly moving sideways during the period. Waste Management is a buy, no doubt, but let’s try and see if financial performance matches current valuations so we can arrive at a well-justified investment thesis.

Revenue Growth

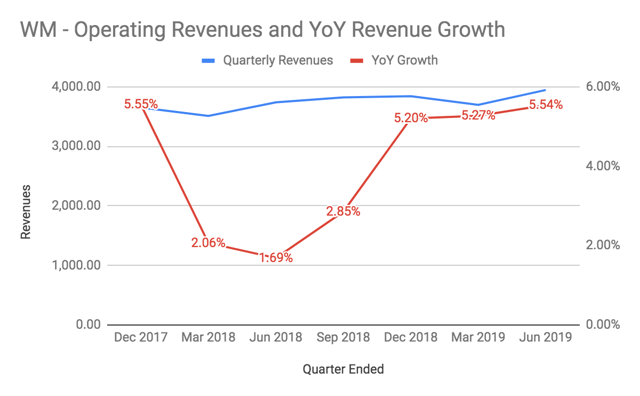

For Q2 2019, the company reported organic growth of 7% in its core collection and disposal business, which drove a 5.5% increase in operating revenues over the prior period.

Source: Data from Seeking Alpha PREMIUM

The past three quarters have seen strong organic growth, and much of that is from the company’s solid waste collection business, which accounted for about two-thirds of total operating revenues in Q2 2019. As such, growth in this segment will remain a key driver of overall growth. The collection segment, which consists of commercial, residential, industrial, and other solid waste, grew by about 5.4% over the prior quarter and about 5.9% for the first two quarters of fiscal 2019.

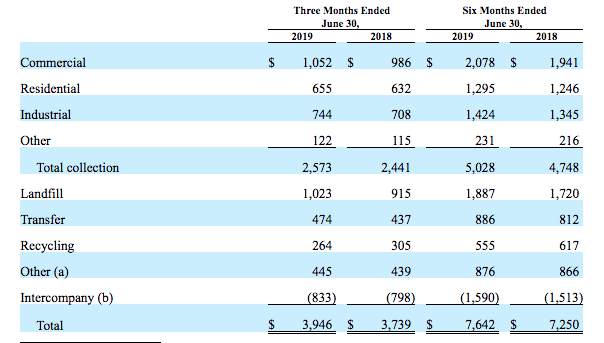

Source: Q2 2019 Filing

Achieving mid-single-digit growth in a mature market like waste management isn’t an easy task, but the company has steadily been acquiring and divesting assets to make that happen. But even excluding the impact of acquisitions and divestitures, the company reported a 4% increase in volume, resulting in the addition of $146 million to its operating revenues. The net impact of acquisitions and divestitures added another 40 basis points to total yield, calculated as the increase/decrease over the prior period divided by the prior period’s revenue.