Source: glassdoor.com.

Overview

Connecticut-based FactSet (NYSE:FDS) is a global provider of financial data and analytic applications for investment management and banking professionals. As of the latest quarter, the company served, in total, 122k+ users (i.e., individuals accessing FactSet services across all client sites) and 5.4k+ clients (i.e., companies subscribing to FactSet services with an Annual Subscription Value, or ASV, greater than $10,000).

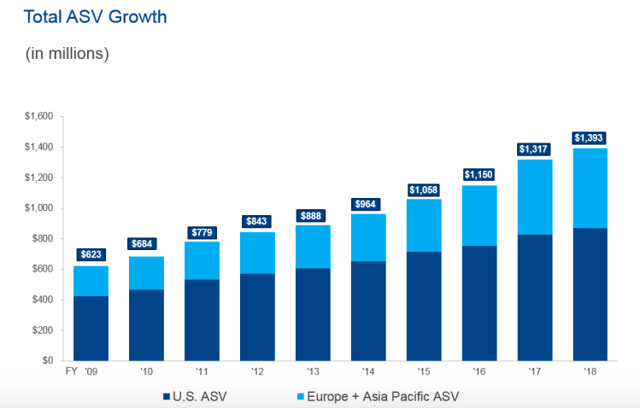

FactSet primarily derives its revenue from subscriptions to products and professional services such as workstations, analytics, enterprise data, research management, and trade execution. This business model is attractive from multiple perspectives - it provides highly predictable sales streams, strong cash generation, economic moat, and high scalability. The management appears to focus a lot on the ASV number, which represents the forward-looking revenues for the next twelve months from all subscription services currently being supplied to clients, and hence, could be a good indicator of generated business value and near-term growth momentum. Thanks to the 95% client retention rate, ASV also sheds the light on long-term visibility for investors. As you can see below, the total ASV climbed steadily YoY for the past few years.

Source: 2018 Annual Report

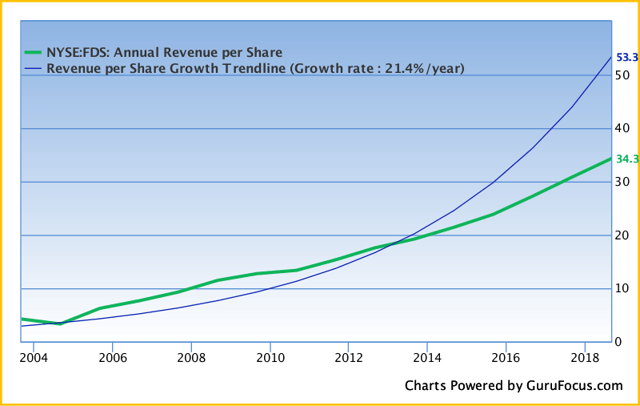

The recurring revenue model at FactSet enables the company to grow its revenue and cash flow smoothly even during the Financial Crisis (see below).

Source: GuruFocus; data as of 9/26/2019.

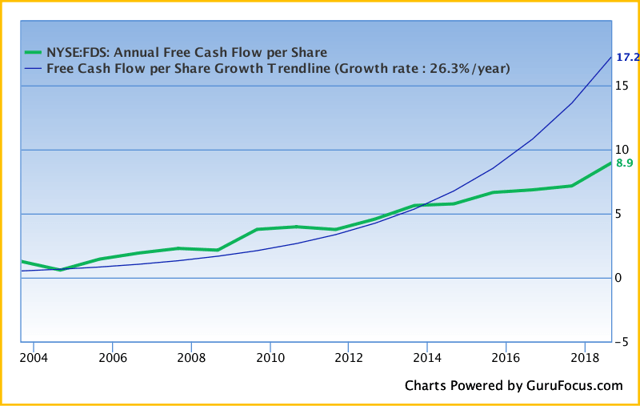

Source: GuruFocus; data as of 9/26/2019.

At the same time, the solid business model also supported the dividend growth at a consistent pace since the payout started (see below).

Source: YCharts; data as of 9/26/2019.

It is worth noting that, per the chart below, FactSet generated more FCF than net profits in most of the years for the past decade, thanks to, again, the subscription business model that requires prepayment. Such strong cash generation has earned the company additional capability and flexibility