I received a few questions related to iron ore lately. Iron ore has been tanking. Here's one (emphasis mine):

Wondering why steel, iron ore and CLF are tanking since Aug 1 with technicals suggesting for CLF for example that in spite of CLF's earnings and sound US based strategy that it may go all the way back below 7. Is this harbinger of even bigger and broader market downdraft coming and is CLF CEO view of $120 Iron Ore new normal completely wrong? What is going on?

Iron ore has been tanking through August and rebounded in September after I received the question.

The first part of the question pertains to Cleveland-Cliffs (NYSE:CLF) and why it is selling off. Recently I had written 'CLF CEO Thinks $120 Iron Ore Is The New Normal'.

The first part of the question pertains to Cleveland-Cliffs (NYSE:CLF) and why it is selling off. Recently I had written 'CLF CEO Thinks $120 Iron Ore Is The New Normal'.

I'll answer this question first and then move on to the broader iron ore question. CLF is sort of trading around the iron ore spot price even though it doesn't exactly serve the seaborne market. You can't see it in the below graph but iron ore price dropped off and CLF just went with it.

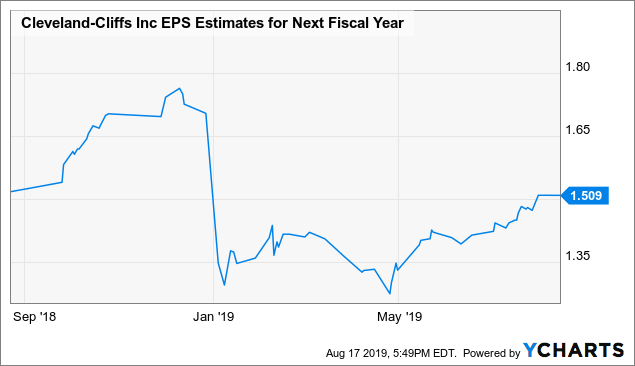

But CLF is a very volatile stock. It is a commodity play and it has leverage and this is often an explosive combination. Now, analysts put estimates for CLF's earnings at $1.59 for next year.

In the near term, I think Cleveland-Cliffs earnings are going to be great due to its long-term off-take contracts. There is a lot of uncertainty around the $1.5 estimate for next year. CEO Goncalves guided towards $800 million in forward free cash flow. That should be a bit less now. But that's still really good on a $2 billion market cap ($3.7 billion EV).

I'm not knowledgeable about technicals but it can surely go below $7 (it recently

Check out the Special Situation Investing report if you are interested in uncorrelated returns. We look at special situations like spin-offs, share repurchases, rights offerings and M&A. Ideas like this are especially interesting in the current late stages of the economic cycle.