Reversal patterns in technical analysis are usually the most difficult patterns to spot early. The reason being is that once a trend is in motion, the odds usually favor the continuation of the trend. This is why cheap stocks can get much cheaper before they finally bottom. The best strategy in these situations is to wait for the trend to change through either a weekly or even better a monthly swing low.

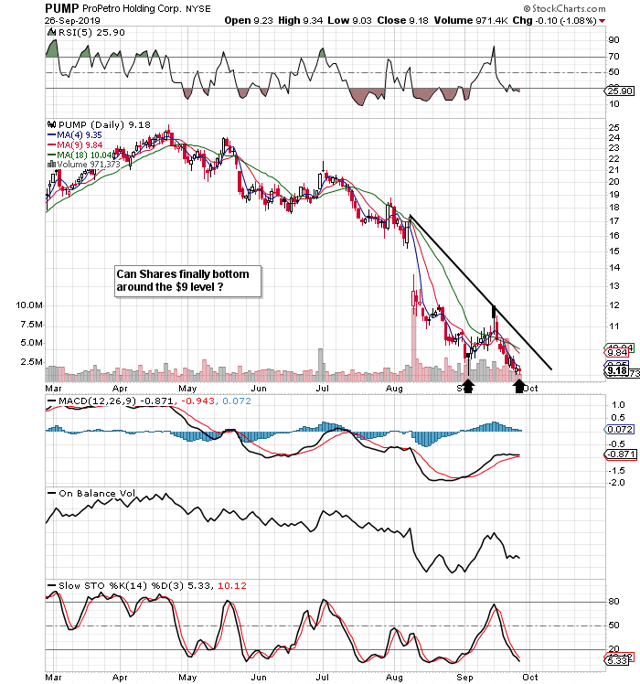

We are presently eyeing up ProPetro Holding Corp. (NYSE:PUMP) ( Oil & Gas equipment supplier) for a potential long swing play. The stock though has been caught in a nasty downturn since April of this year. Shares finally bottomed in early September and are now retesting that low over the past few trading days. The question now is whether we have a double bottom reversal pattern in play or are there lower lows on the cards.

When we have these setups where the stock has been literally left for dead, we like to go through the financials and valuation to see how they have been trending. Any insight that we can get from these trends is critical at these junctures. Why? Because spotting and then trading a pattern early can make an enormous difference to the return one can make on the respective trade.

For example, at present, even if ProPetro were to finally bottom in the not too distant future, we could easily get a head and shoulders pattern which would mean lower lows in the near term (head). Therefore, let's see how the firm's financials are trending at this present moment in time.

Growth in both the top and bottom line has been really impressive since 2015. Over a twelve-month trailing average, top-line sales have climbed to $1.93 billion and net profit has reached $204 million. ProPetro has a very strong

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

-----------------------